This stock is WAY underpriced. Equity per share is $16.07, and yet the price is below $5! Having shares of DSS will give you two shares of the Impact IPO that will be released in 2021.

Update (12/22/20): Still holding strong! I believe the price of this stock will come close to doubling in the coming months.

Update (1/19/21): Nothing has changed yet. I’m awaiting news on the Impact Bio IPO shares that we will obtain for holding this stock.

Update (1/26/21): Blegh. DSS had an offering, but the stock price has gone up since then. It’s a nice time to buy low, especially with shares of Impact IPO coming soon.

Update (1/31/21): No real update. Waiting on Impact IPO news.

Update (2/7/21): DSS had a second offering, which sucks in the short term, but the money will likely be used to make an acquisition of some sort. This is one of my least-favorite stocks right now; I’m only holding on for the Impact IPO shares.

Update (2/15/21): Just a reminder that the float here is just 4.35 million shares, and this stock is 14.7-percent shorted. This could blow at any moment.

Update (2/21/21): This continues to be undervalued. Be patient, and it’ll pay off.

Update (2/28/21): This stock was hurt by the market crash and the Bitcoin drop – they handle blockchain security – which would explain why it dropped to $3.50. This is very undervalued. Increasing to two stars.

Update (3/5/21): There’s no news here, but the $3 price is way too low. This is a bargain right now, but I wouldn’t be surprised to see this go to $2.50.

Update (3/14/21): DSS is approaching $4 again, and I’m bullish on it eclipsing that figure this week. With Bitcoin soaring, blockchain plays should do well, and this is one of them.

Update (3/21/21): DSS had a nice week, closing at $4.26. It sounds like Impact Bio IPO share distribution will be in Q2. For every share of DSS you own by a certain date, you’ll get two shares of Impact. I currently have 3,500 shares, and I’m looking to add more if this dips under $4.

Update (3/28/21): It’s not shown above, but I bought some DSS under $4. This is an NFT play that hasn’t spiked yet.

Update (4/4/21): Some of my DSS shares were borrowed, but not all of them. This is a cheap buy with tons of upside. Now that this is well under $4, I’m bumping it up to three stars.

Update (4/11/21): DSS dropped on low volume this past week. It’s insanely cheap at the moment.

Update (4/18/21): DSS continues to fall because of manipulation. It’s extremely oversold and will have a huge bounce once there’s some news.

Update (4/25/21): DSS announced that they are moving to a huge facility (150,000 square feet), which could come with some other news. There are so many catalysts with this company. Given the new short-selling rules, this could squeeze sooner than expected.

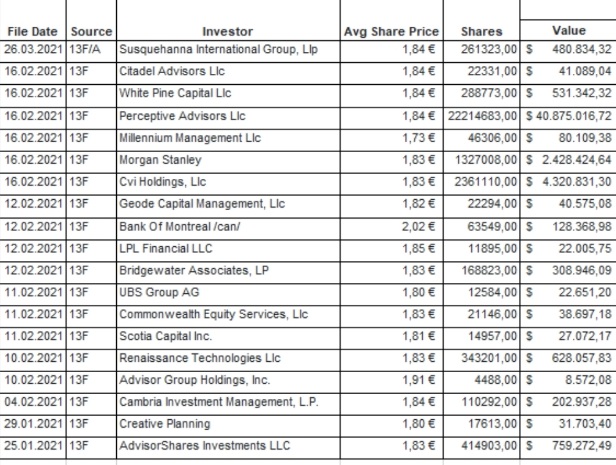

Update (5/8/21): A 13F filing revealed Friday that Blackrock bought 525,000 shares of this company at $4.67. Think of how undervalued DSS is at the moment.

Update (5/16/21): Here’s another nice 13F filing: Vanguard bought 435,000 shares at $4.92. DSS continues to be a heavily shorted undervalued stock.

Update (5/23/21): Goldman Sachs used to own a position in DSS, but they sold off back in 2018. Well, they’re back! They just bought 131,000 shares.

Update (5/30/21): Here’s some more inside buying: The Ultra-Small Company Market Fund bought 100,500 shares of DSS at $3.61. At any rate, the CEO of DSS announced that we’ll have a record date set for the Impact IPO at the end of the second quarter, so we should have news in the next 30 days.

Update (6/6/21): We’re still waiting for Impact news, but it was nice to see a Vanguard index fund buy 26,173 shares of DSS at $3.61 per a June 1 13F filing.

Update (6/13/21): We had some good news this week on DSS. Nothing on the Impact front, but the company was added to the Russell micro cap index. That could help as a catalyst for this to squeeze, which is long overdue.

Update (6/20/21): Good news/bad news. The bad news is that DSS had an offering, which sunk the stock price. The good news is that the CEO bought 1.7 million shares after the offering. So, the CEO made money issuing new shares and then bought a bunch of shares cheaply, which I think is a good thing in the long run. Hopefully we get some great news soon (including Impact IPO.)

Update (6/27/21): Thanks to last week’s purchase by the CEO, Fintel has given DSS a 90.34 ownership score, which is 353 out of 11,725. The ownership score is a “sophisticated, multi-factor quantitative model that identifies companies with the highest levels of institutional accumulation.” The CEO bought this stock cheaply, so he obviously knows something that could cause the price to rise.

Update (7/4/21): Well, it’s July, which means that Q2 is over. And yet, we’ve heard no news on the Impact Bio IPO. However, the CEO bought a ton of shares around this price, so he expects it to rise. Also, I was looking at the filings, and I wasn’t happy to see that Citadel owned 35,000 shares of DSS. Ken Griffin will likely have to sell those shares once he gets squeezed out of AMC, but 35,000 shares won’t make or break this stock price.

Update (7/11/21): Nothing new to add this week except some chart stuff. DSS’ RSI is 28.65, which means that it’s incredibly oversold.

Update (7/18/21): DSS’ RSI is even lower than last week. It’s now 24.58. Remember, the CEO of this company recently bought a ton of shares, so he knows that the price will rise eventually. This could go once we’re out of this miserable bear market.

Update (8/1/21): This stock has been a huge turd for a while, but I’ll remind you of what I wrote two weeks ago: The CEO of this company bought lots of shares, so he’s expecting something good to happen with it soon.

Update (8/8/21): Nothing changed this past week – there weren’t any new filings of note either – but I will once again point out that the CEO bought 350,000 shares, so he expects this stock to rise.

Update (8/15/21): Vanguard Group bought 1.4 million shares of DSS at an average price of $2.70! Between this, as well as the CEO’s purchases, someone knows something.

Update (8/22/21): Nothing new to add at the moment. As I’ve been writing, the CEO bought lots of shares recently, so something’s going to happen soon.

Update (8/29/21): Morgan Stanley bought 90,000 shares of DSS, and there was a report about Impact BioMedical reporting psitive test results. That’s great and all, but I’d love to get some news on Impact BioMedical’s IPO so we can get some free shares.

Update (9/5/21): Zzzzz…

I have nothing to say about this right now. The CEO bought shares, so he’s expecting something good to happen.

Update (9/12/21): It appeared as though we had a glimmer of hope when DSS jumped from $1.33 to $1.41 one day, but then it went back to $1.33. The news here was that DSS invested $40 million into American Pacific Bancorp (APB), becoming a majority shareholder. APB will issue 6.7 million shares of its common stock to DSS at $6 per share. This could be why the CEO was buying his shares earlier. And speaking of, let’s see what the CEO did this week…

Wow, a 12 million-share purchase! That’s some major conviction. I’ll be buying more shares this upcoming week.

Update (9/19/21): I bought more shares as promised, though I waited until the end-of-week dip. It dawned on me that the CEO buying all of those shares could mean that he expects the Impact BIO IPO to happen soon.

Update (9/26/21): I bought even more shares this past week after the Monday market crash. News has to be coming soon because the CEO bought so many shares.

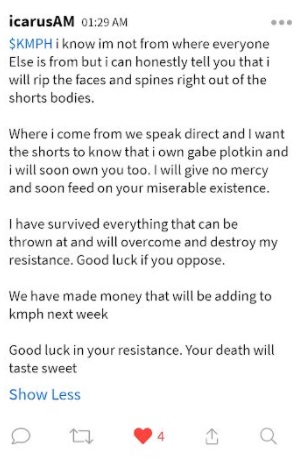

Update (10/3/21): There are dumb FUD bears spreading dilution scares on StockTwits, but that doesn’t seem likely because of all the shares the CEO has purchased. It’s more likely that big news is coming soon.

Update (10/10/21): We’ve reached a lower price compared to where the CEO bought shares of this company. This seems like a bargain, but I can understand why people would be skeptical, given this company’s dilution-crazed past.

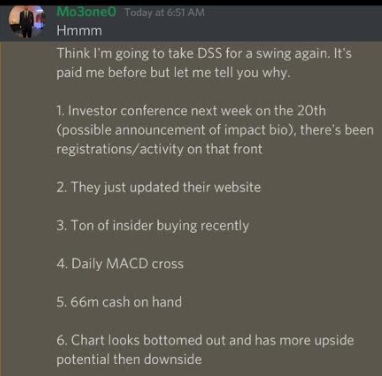

Update (10/17/21): Here’s a good summary of why I like DSS right now:

The CEO bought tons of shares. That has to mean the Impact Bio shares are coming soon. I bought more shares Friday.

Update (10/24/21): Spire Wealth Management bought 30,000 shares of DSS, effective Sept. 30. Like the CEO, this hedge fund realizes something big will happen here soon.

Update (10/31/21): DSS popped a bit this past week, but it seems as though there’s more to come. Check out this nice DD that I found:

Update (11/7/21): Breaking news: DSS Acquires Three Established Acute Care Hospitals in Texas and Pennsylvania.

Update (11/14/21): You better believe there will be some tax selling here, thanks to the multiple offerings from this company this past year. However, as mentioned repeatedly, the CEO bought tons of shares around this price, so he expects this stock to increase in price at some point.

Update (11/21/21): It’s hard to believe that this dropped below $1 when the CEO bought shares at a higher price. According to FinViz, DSS book value is $4.80, which just shows how undervalued this stock is.

Update (11/28/21): I still can’t believe that this stock is so cheap after the CEO bought above $1. I purchased more shares this week at 86 cents.

Update (12/5/21): I keep saying this, but the CEO bought above $1. I don’t think he’s going to dilute more after doing so. I would expect more share repurchasing than anything.

Update (12/12/21): DSS had a nice run this past week, at least until Thursday. This is still a great price, as RSI is at 34.

Update (12/19/21): There was more inside buying this week from DSS owners. Like CLOV, this too has a no-buy 30-day window at the moment.

Update (12/26/21): DSS had a nice move from 67 cents to 78 cents this past week, but the price is still way below at which the CEO bought. DSS has some gaps to fill, so perhaps we’ll get there at some point in 2022. It would help if we got some Impact Bio news!

Update (1/9/22): DSS is back to 67 cents, so perhaps this is the bottom of the chart. I suspect we’ll go above $1 again once the small-cap shorting stops, which should be soon.

Update (1/16/22): DSS’ market cap is $56 million, and their annual revenue is $19 million. There’s a bit of a disparity there, but the CEO bought shares above $1.

Update (1/30/22): DSS’ market cap is down to $33.8 million. Their revenue last year was half of that. Unfortunately, there’s nothing of note related to on-balance volume.

Update (2/6/22): DSS’ cost to borrow has doubled from 0.6 to 1.3 percent. That’s not a high number, but at least it’s something…

Update (2/13/22): The borrowing fee has remained stagnant, much like the price. Remember, the CEO bought shares at a much more expensive price than this.

Update (2/27/22): Nothing new thee past two weeks. Waiting for this company to release news is like watching grass

Update (3/6/22): DSS rose twice to around 60 cents because the CEO published a letter to shareholders. There were plenty of big promises in this letter. This could be more talk, no walk, but the insiders bought lots of shares at a higher price than this.

Update (3/13/22): DSS had an amazing week, with the CEO of this company buying $4 million shares! Something is going down soon, perhaps regarding the Impact Bio shares.

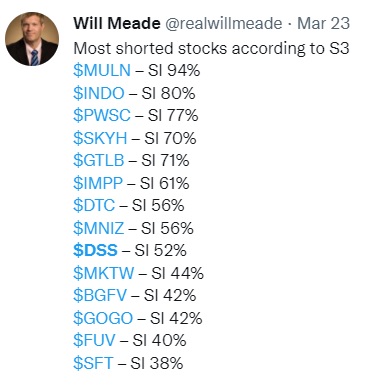

Update (3/27/22): Will Meade highlighted DSS in a tweet last week:

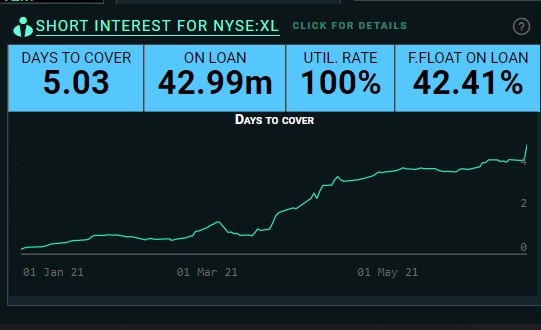

I honestly didn’t even know that DSS was that heavily shorted, so I was glad to see this.

Update (4/3/22): Nothing new this week. This is still undervalued.

This stock fell from $60 to $35 because of the 180-day lockdown period, plus election week. This is a great buy-low opportunity for a company with a billion in cash and no debt. DraftKings is the future of fantasy football and gambling. It will be $100 one day.

Update (12/22/20): Andrew Cuomo has destroyed New York, so he may be forced into legalizing gambling. If so, we may see a $100 price.

Update (1/19/21): We’re still waiting on New York to legalize gambling. It’s going to happen sooner or later because the dumb politicians in New York have bankrupted the state. Hey New Yorkers, you may want to vote these idiots out at some point.

Update (1/26/21): No change. Come on New York, legalize sports gambling!

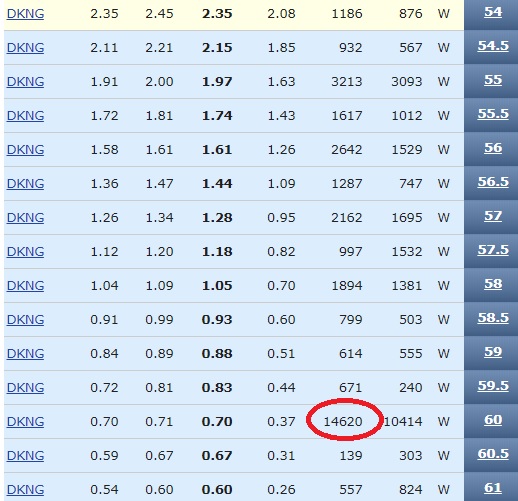

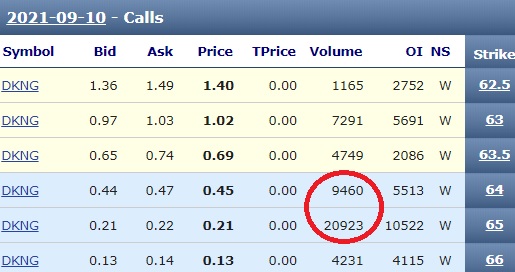

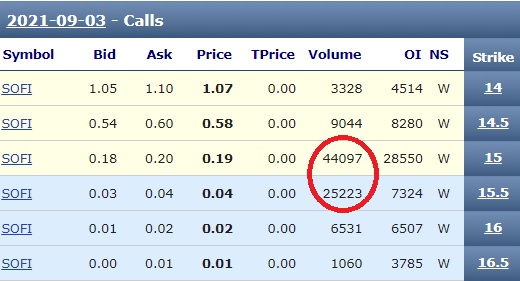

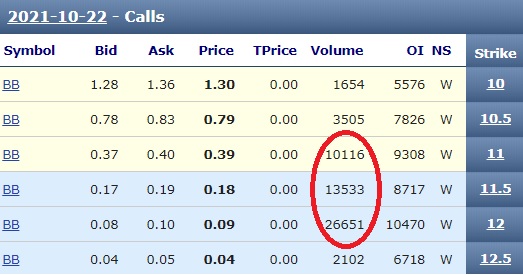

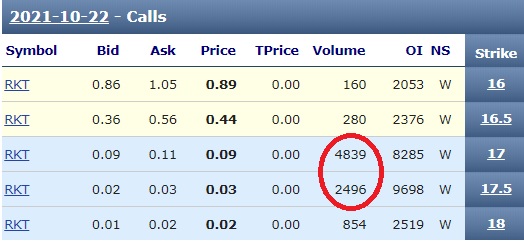

Update (1/31/21): These are so many $60 calls of DraftKings expiring Friday, Feb. 5:

If the stock price closes above $60 next week, this will skyrocket the following week. Look for the scumbag shorts to keep this below $60 with all their might.

Update (2/7/21): The stock closed above $60, so it should continue to rise. DraftKings remains a strong play until some of the major states legalize sports betting.

Update (2/15/21): The most Feb. 12 calls were at $60 and $61, and they all finished in the money, which provides a nice outlook for the coming week. The most Feb. 19 calls are currently for $65, so let’s see if this trend continues.

Update (2/21/21): The most Feb. 19 calls ended up being at $60, which were in the money. I don’t see why this wouldn’t keep going up. We’ll see $100-plus at some point.

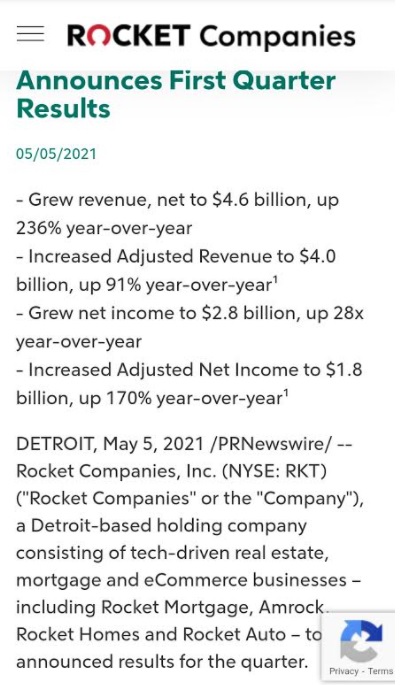

Update (2/28/21): DraftKings just had a great earnings report, and they just increased their revenue guidance. There’s no reason this should be trading for less than $100 per share.

Update (3/5/21): DraftKings should have soared in the wake of their great earnings, but the market crash prevented that from happening. We’ll see this approach $100 once everything returns to normal.

Update (3/14/21): DraftKings crossed $70 for the first time this past week. With Penn running to $130, we should see DraftKings make a run to triple digits soon.

Update (3/21/21): DraftKings had a strong close to the week, finishing at $71.98. DraftKings basically just prints money, so the sky is the limit for this company.

Update (3/28/21): DraftKings dropped along with everything else last week. Anything less than $60, and you could be looking to double your money within a year.

Update (4/4/21): No DraftKings shares were borrowed (see CLOV for details.) There’s some negativity here, however, because Major League Baseball engaged in SJW nonsense by moving the All-Star game out of Atlanta. I don’t think it was a coincidence that none of DraftKings’ MLB contests filled that day.

Update (4/11/21): There are rumors of sports betting being legal in New York by the beginning of the NFL season. If that happens, this will take off toward $100.

Update (4/18/21): DraftKings has partnered with the NFL to be their sports betting partner. You’d think this would cause its stock price to skyrocket, but it barely moved.

Update (4/25/21): I still have no idea how DraftKings is under $100, let alone $60. I have no news to report, but this continues to be undervalued.

Update (5/8/21): I wrote above that the market felt like a bottomless pit this past week. Companies with great earnings tanked, and that includes DraftKings. It beat revenue estimates, yet lost money because they spent a ton on advertising. This reaction might be the dumbest thing ever. Why would DraftKings be punished for advertising in an attempt to recruit future customers? It makes no sense. They basically print money, and they should be over $100 right now.

Update (5/16/21): I don’t understand how DraftKings fell to $41 at some point this week, but it jumped back up on Friday. This is still a nice time to get into DraftKings, which should be at least $100.

Update (5/23/21): We don’t have 13F filings for what has transpired since DraftKings dipped into the $40s, but I imagine plenty of institutions have been loading up on this very cheap price.

Update (5/30/21): DraftKings had a nice rally this week, shooting back up into the $50s. This is still an undervalued company with tons of cash and no debt.

Update (6/6/21): DraftKings remained stagnant this past week. A Vanguard index fund bought 113,340 shares at $61.13, according to a June 1 13F filing.

Update (6/13/21): DraftKings moved from $50 to $56 early in the week, but then fell to $53 on Friday. There are no new filings to speak of, save for 14,842 shares purchased by some entity called Prentice Wealth Management.

Update (6/20/21): DraftKings has been heavily shorted recently. There was a bogus hit piece that dropped the share price. DraftKings is now 9.8-percent shorted, which doesn’t sound like very much unless you factor in the large float. There are 33 million or so shares shorted, so we’ll have a squeeze at some point.

Update (6/27/21): DraftKings had a nice week, as sports betting will likely be legalized in Canada soon. Now that they’re done throwing healthy people into gang-run hotels, they’re finally concentrating on improving their economy.

Update (7/4/21): DraftKings remained steady this week, at least until Friday, which was a very red day for most of the market. At any rate, DraftKings has become more shorted recently, with the short interest rising to 10.5 percent. That may not sound like much, but DraftKings’ float is 366 million shares, which means 36.6 million shares will be bought by short-selling scum at some point.

Update (7/11/21): There was some major insider selling at the end of the week, which was disappointing to see. This has happened often, so I think DraftKings would’ve cracked $100 already if that didn’t happen. On the bright side, State Street bought 220,000 shares at an average price of $53.94, per a July 9 13F filing.

Update (7/18/21): A week after State Street bought 220,000 shares, Addison Capital purchased 56,000 shares at an average price of $56.69. DraftKings’ RSI is 29.49, making it extremely oversold.

Update (8/1/21): I mentioned Alliancebernstein earlier. They bought 283,000 shares of DraftKings on June 30 at an average price of 56.71.

Update (8/8/21): DraftKings had a nice earnings report, prompting the largest volume Friday that we had seen in about a month. This continues to be undervalued, as DraftKings basically just prints money.

Update (8/15/21): I’m grouping DraftKings and Golden Nugget together because DraftKings bought Golden Nugget! Those who have GNOG shares will receive .365 DKNG shares for each one at some point during Q1 of 2022. Thus, DraftKings and Golden Nugget will move together until then. I haven’t sold any of my GNOG shares in the wake of the news. I believe DraftKings should be at least $80, which would make Golden Nugget worth $29. At $100, which is reasonable as well, Golden Nugget would be $36.50.

Update (8/22/21): And so we wait. I believe DraftKings will be a $100 stock one day. I have no new updates this week, as we’re just waiting on news.

Update (8/29/21): DraftKings had a great week, so Golden Nugget did as well because they are moving together. There was awesome news Friday that ESPN is exploring a sports-betting deal worth at least $3 billion with Caesars and DraftKings. Also, we had another big buy: Morgan Stanley bought 600,000 shares of DraftKings.

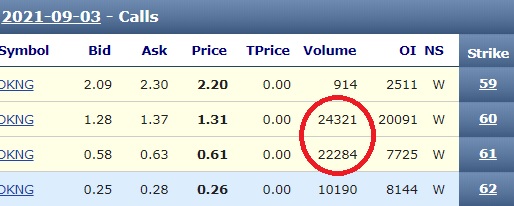

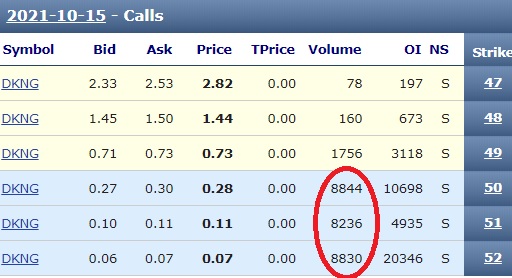

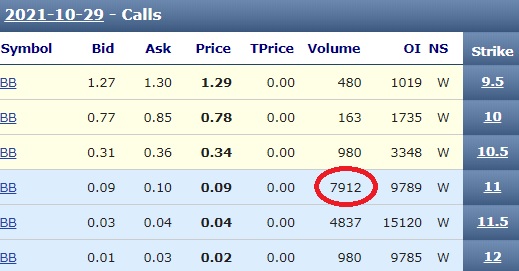

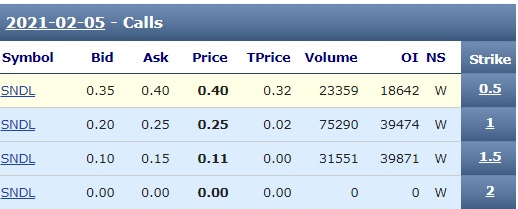

Update (9/5/21): The bad news is that the hedge funds dropped this below $61, so lots of call options at that price finished out of the money. The good news is that there were slightly more in the money at $60:

It was nice to see this, so perhaps we’ll continue our trajectory up toward $100 soon.

Update (9/12/21): Perhaps getting some momentum from the start of the NFL season, DraftKings had a nice run up to $64 before it was rejected into the $62-63 range to end this week. Why did it fail to reach $64? Market manipulation, of course! The market makers certainly couldn’t allow those $64 call strikes to finish in the money:

Nevertheless, we have some big news:

The sports betting market is growing every year, and I’m glad I’m along for the ride.

Update (9/19/21): Macquarie issued a price target of $75 for DraftKings. We’ll go beyond that if ESPN news is officially released.

Update (9/26/21): DraftKings and Golden Nugget shares fell this weekend because DraftKings put in an expensive bid offer for another company. I saw speculation that DraftKings was simply doing this to drive up the price for its competitor, but this is all just speculation. There’s a nice dip buy opportunity with these companies right now, as DraftKings is basically printing money this football season.

Update (10/3/21): The down market and the nonsense bid offer I wrote about last week caused DraftKings to drop to $48. I considered buying more shares, but I thought it might drop lower. That didn’t happen, as DraftKings rose on Friday.

Update (10/10/21): The deal referenced on Sept. 26 hasn’t been canceled yet, which is why DraftKings is hovering below $50. This stock price will rise again if that bogus deal is nullified.

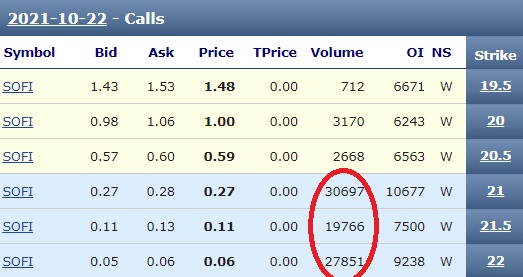

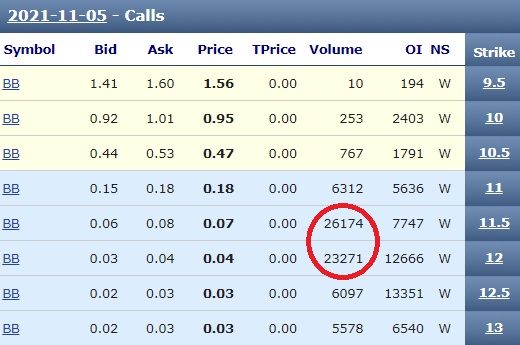

Update (10/17/21): There were tons of calls at every price at $50 or above, which is why the market makers dragged DraftKings down late in the week:

If you know some poor soul who buys calls each week, please send them here so they can see all the blatant market manipuation that happens all the time.

Update (10/24/21): The dropped price on Friday seems to be in relation to growth stocks taking a hit from interest rates. DraftKings is cheap, however, and definitely worth buying at this price.

Update (10/31/21): The deal has been nullified, yet this stock didn’t recover. It remains a nice value at the current price. Earnings, by the way, will be on Friday.

Update (11/7/21): The stock market is stupid sometimes, or maybe all the time. DraftKings plummeted Thursday because Penn posted disappointing earnings. DraftKings’ Friday earnings were fine, but the guidance was great. The CEO discussed a great 2022 and even said he expects a trillion dollars in revenue in the 2030s.

Update (11/14/21): DraftKings continues to tank, as the earnings report revealed that they’re burning through cash. Yes, it’s called spending money to make money, which is what growth companies do! DraftKings is very cheap right now, but I think we could see a drop into the $30s. Just a guess.

Update (11/21/21): DraftKings and Golden Nugget plummeted all week, with the former hitting the high $35s on Friday. We’re at a 52-week low for DraftKings, making it a great bargain at this price.

Update (11/28/21): I bought more shares of Golden Nugget this week at $12.50. There’s no reason it or DraftKings should be this low. The entire sector is down, so it’ll bounce back soon.

Update (12/5/21): I don’t think I’ve seen an RSI 16 except during March 2020. It would be crazy not to buy DraftKings at this level.

Update (12/12/21): DraftKings/Golden Nugget ran well early in the week, but collapsed along with the market by Friday. Penn is also down, as the entire sports-betting market is down for some reason. Everything is dirt cheap. It looks like we have resistance on DraftKings at around $27.50, so I have a buy order in place at that price.

Update (12/19/21): I bought more DraftKings shares at $27. The entire betting sector is laughably oversold. I like PENN in addition to DKNG and GNOG.

Update (12/26/21): There looked to be some momentum for DraftKings early last week, but that changed. I think DraftKings has left a bad taste in people’s mouths after all the inside selling it did earlier this year. However, it’s still oversold with an RSI of 39.

Update (1/9/22): DraftKings hit as low as the high $23s, but it has since rebounded a bit. We have multiple instances of the gambling stocks not moving with the overall market, so like the BANG KEN stocks, these could rise while everything owned by the hedges plummets.

Update (1/16/22): I can’t believe DraftKings dropped to $22 on Friday. The entire betting sector has been shorted, from DKNG, to PENN, to FUBO, to CZR. It seems as though some hedge fund managers had one of their fancy dinners at some point during the summer and colluded to bring down the betting sector. Everything is super cheap and heavily shorted now. I bought more DKNG at $22.60 on Friday.

Update (1/30/22): I bought more DraftKings shares at $17. The stock price rose later in the week on news of a price target increase, with Morgan Stanley upgrading its target price to $31.

Update (2/6/22): Morgan Stanley upgraded DraftKings’ target price to $31. Its merger with Golden Nugget should occur soon.

Update (2/13/22): The betting sector continues to be on sale. There’s no reason DraftKings should be this cheap.

Update (2/20/22): DraftKings’ earnings were released Friday. It beat revenue and raised its 2022 revenue guidance. All of this is great, yet the stock dropped 21 percent because, as some dumb Stocktwits bears said, “DraftKings burns through money.” Uhh… yeah. That’s what growing companies do. They spend money to acquire new customers. And yes, new customers for a company that has been around so long because they’ve moved into new markets recently like New York. This stock price drop is completely unwarranted.

Update (2/27/22): DraftKings rose about $5 this past week. As I’ve been saying, the entire gambling sector took a dive in recent months, so it appears as though this is the beginning of a reversal.

Update (3/6/22): DraftKings looked to continue its reversal, but the end of the week was brutal. There was some major selling on Thursday and Friday, which was discouraging.

Update (3/13/22): DraftKings continues to plummet for some reason. The CEO, Jason Robins, tweeted this on March 8: “If you sold #DKNG today, just be aware that my team and I are on a mission to make you regret that decision more than any other decision you’ve ever made in your life.” Oh, really? Then why did he and his board members sell tons of shares before that? Robins spent the rest of the week making a Ukraine logo for his Twitter bio and tweeting about International Women’s Day, as if anyone cares. I love DraftKings, but this Jason Robins guy can’t be trusted with his constant virtue signaling and lying.

Update (3/27/22): We’re still waiting to see how Jason Robins will make sellers regret selling. This stock has been frustrating, but the entire gambling market is in shambles. Take a look at PENN if you want to see a blood bath.

Update (4/3/22): Q1 is over, and yet there has been no merger. Meanwhile, the gambling stocks continue to fall. I suppose the bear thesis is that people won’t gamble in a recession, but degenerates will always gamble.

I’m not a big penny stock guy, but this should be $2 at least. They’re the only company with at least a billion in revenue ($1.3 billion in 2020) trading below 50 cents. Debt is the big issue, but they just received a huge contract from the VA and a deal with Mastercard to pay off the debt. With that, and other big contracts, debt will be a thing of the past. This company is expecting a great earnings report for Q4.

Update (12/8/20): This stock hasn’t moved much since posting, but we’re waiting on what should be an outstanding Q4 earnings report.

Update (12/22/20): I sold my shares when this hit the 50-cent range on Friday. I’m interested in re-buying in the low 40s.

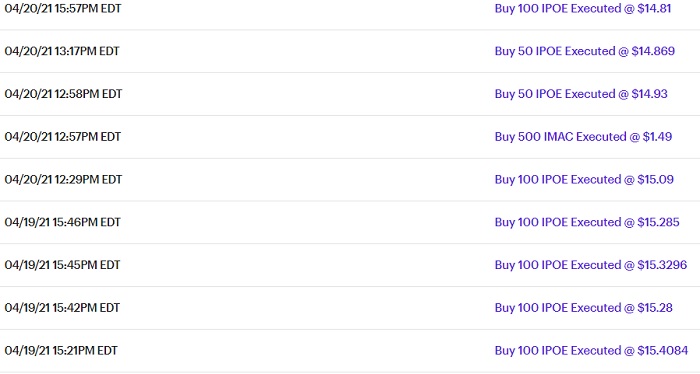

Update (1/19/21): This hit $1.10. I put in a stop loss at $1, and it sold once the stock fell back to that price. I’ll be interested in re-buying if this falls again.

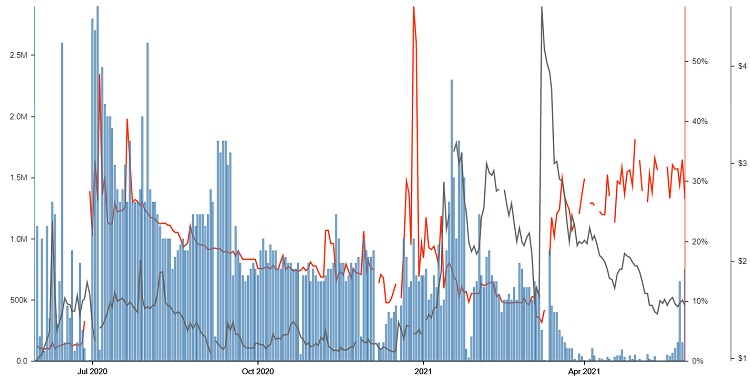

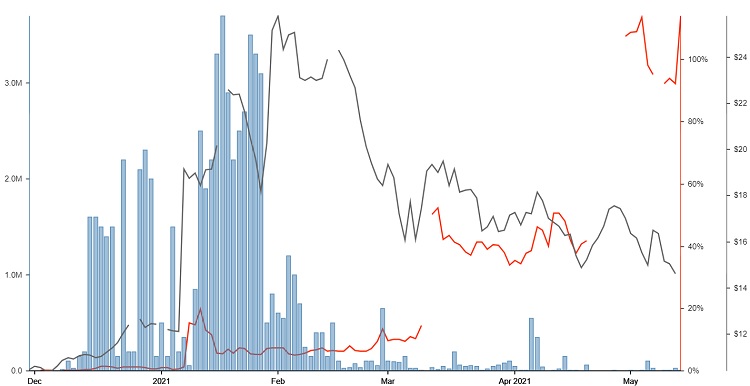

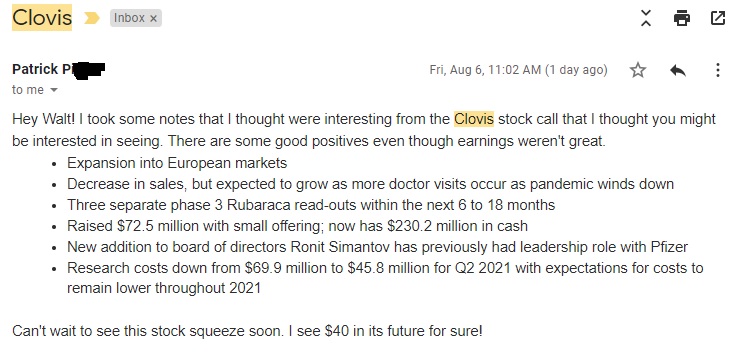

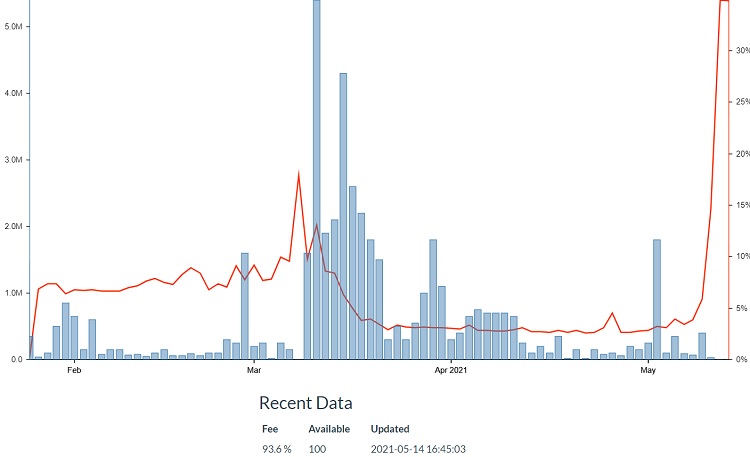

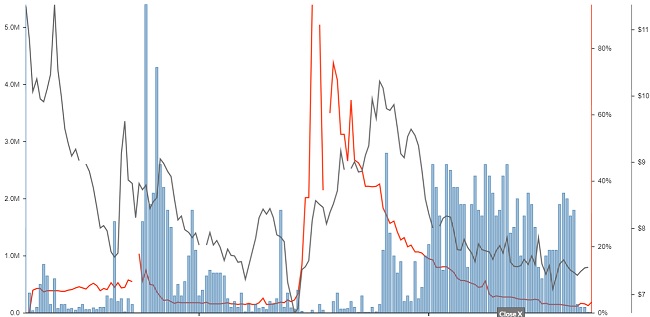

Update (5/30/21): I’m back in XELA. This has been shorted into oblivion. Take a look:

The black line is the stock price. It reached close to $5 in March, but then the cockroach shorts infested this company. The borrowing fee, depicted by the red line, rose in response. It’s now in the 30-percent range, so it’s becoming harder to short this company. Exela produces a billion-plus in annual revenue, and they tend to receive big contracts, so their next deal could have the scumbags scrambling to cover.

Update (6/6/21): If you’re in AMC, you might be familiar with naked shorting and fails-to-deliver. There’s some of that in this stock as well, so XELA is a huge candidate for a squeeze.

Update (6/13/21): I’ve heard that this stock has gained some traction on WallStreetBets. It’s a highly shorted stock, so it’s only a matter of time before the WSB crew really finds it.

Update (6/20/21): Exela isn’t heavily shorted, but the borrowing fee is high, so the shorts will be pressured to cover at some point. Exela is good for some big news about once per quarter that will cause the price to shoot up.

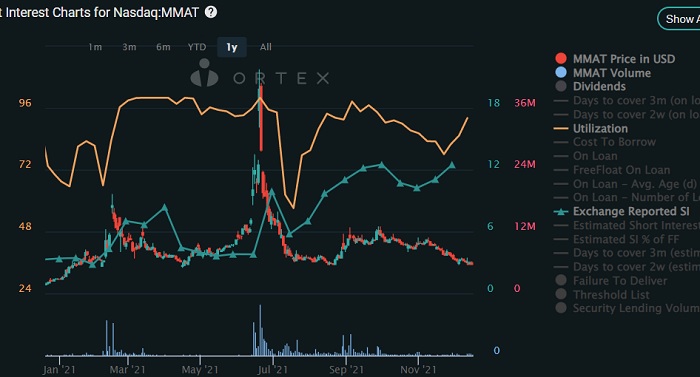

Update (6/27/21): Some clarification on the past two entires. I wrote Exela was highly shorted on June 13 and then not so highly shorted on June 20. This sort of data can be imprecise, and I was looking at two sets of numbers. Ortex says Exela isn’t heavily shorted, and yet the borrowing fee is very high, which is confusing.

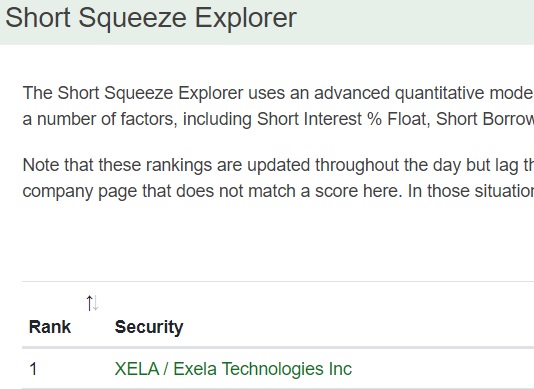

Update (7/4/21): I sold half my Exela when it reached $2.50, and I plan on buying those shares back if it falls a bit more. I can now confirm Exela is heavily shorted. It’s 35.6-percent shorted, according to Ortex, and it’s the No. 1 squeeze candidate on Fintel:

It should be noted that Exela diluted its shares when it rose above $2.50, but I’m not very upset about that because they needed to address their debt. With less debt, the stock price is bound to increase eventually.

Update (7/11/21): Exela closed just shy of $3. It’s still heavily shorted – it is currently second on the Fintel Short Squeeze Explorer – so we still have some room to rise. My conservative price target is $5, but it could easily go higher.

Update (7/18/21): I sold half my shares at around $4.50. I’m still holding the rest for an even greater run. The price could drop, and if it goes below $2, I’ll add to my position.

Update (8/1/21): We remain in limbo with Xela. It’s too cheap to sell, but a bit too expensive to buy.

Update (8/8/21): Nothing has changed with Xela. We’re still in limbo. That said, the short interest is still very high (23%), so this company will squeeze eventually.

Update (8/15/21): Will Meade, a former portfolio manager at a hedge fund, tweeted that S3 has Exela as the most shorted stock in the market, percentage-wise. I still think it’s a bit too expensive to buy at the moment.

Update (8/22/21): There were some big buys reported this week. Luminus Management bought 437,000 shares of Exela, while Davidson Kempner Capital bought 550,000 shares of Exela. They did so cheaper – the filings are as of June 30 – so I don’t think we’re in buy territory yet, but we’re close.

Update (8/29/21): I came close to buying Exela on Thursday, but I wanted to see if the price would fall below $2 on Friday. Instead, the price rose. As I’ve mentioned previously, I lend my shares so I can further understand the borrowing fee and the demand for shorted shares, and none of my Exela shares have been borrowed for at least two weeks. That tells me there’s more room for the downside on this stock, but I’m not bearish on it. This company has immense potential, but the bears have a legitimate case because of the debt.

Update (9/5/21): We’re still in no-man’s land regarding buys and sells. I’d love to see the borrowing fee rise into the 30-percent range once again to put pressure on the short sellers, but it’s very low at the moment.

Update (9/12/21): I’m going to say the same thing as last week, though I’d like to point out that utilization reached 80 percent on Tuesday before falling down. There’s also this:

If this drops a bit more, I will buy more shares.

Update (9/19/21): Utilization is down in the dumps at 50 percent. I’ll buy more shares of this stock when the price drops below $1.80 and the utilization reaches 80 percent again.

Update (9/26/21): I came close to pulling the trigger at the end of the week, but I’m still waiting for $1.80. Utilization, however, has risen to 70 percent.

Update (10/3/21): Utilization is now up to 80 percent. I had a buy order of $1.80 on Friday that didn’t fill.

Update (10/10/21): I know I had a $1.80 buy order last Friday, but I couldn’t pull the trigger on $1.65 this week. I think there’s more downside coming in this crappy economy before we rip. I want to see utilization climb to about 90 percent.

Update (10/17/21): Utilization dipped a bit this past week, dropping to 76 percent. I still haven’t bought any shares.

Update (10/24/21): Xela’s short interest just hit a yearly high:

Also, Evanson Asset Management bought 37,243 shares of XELA, effective Sept. 30. I finally picked up more shares on Friday at $1.52.

Update (10/31/21): I’m glad that I picked up those Exela shares because the stock rose this past week. This as because Exela announced a partnership with CareSource, one of the nation’s largest Medicaid managed care plans.

Update (11/7/21): Exela posted a positive earnings report that featured a 25 percent reduction in debt, which is the major issue holding this company back from being a double-digit stock. I put in a buy order for Exela for $1.74 on Friday, but it never filled. I’ll try again next week.

Update (11/14/21): There was a nice insider buy of 100,000 shares done Friday. I put in a buy order for mor shares at $1.58 during the afternoon, but it didn’t fill.

Update (11/21/21): Despite there being a 100,000-share buy from an insider last week, Exela’s stock price dropped this past week along with everything else. I bought more shares at $1.39.

Update (11/28/21): This stock is way too cheap now. I bought more shares at $1.29 on the 23rd.

Update (12/5/21): Exela’s RSI is 29. The last time it was this low, the stock price was $1.40, and it immediately popped back up to $2.38.

Update (12/12/21): Exela got a nice bump early in the week, but fell a bit at the end, just like everything else. I put in a buy order at $1.09.

Update (12/19/21): I actually just put in a buy order for Exela at $1.05, so you’ll see that next week if it’s not filled. There was more inside buying from the board members of this company. We’re currently at 52-week lows.

Update (12/26/21): I ended up getting more shares at $1.05. Again, we’re near all-time lows, making this a great value buy right now.

Update (1/9/22): I added more shares in the 60s and 70s. Excluding March/April 2020, we’re at all-time lows. The RSI is 20! There’s no reason this stock should be so low. Exela’s market cap is $132 million, and yet the yearly revenue is $1.1 billion! Sure, they have debt, but they make enough money to eventually pay it.

Update (1/16/22): Exela’s market cap has collapsed to $102 million, yet their annual revenue is $1.1 billion. This could 10x, and yet it would still be undervalued. I bought more shares this week.

Update (1/30/22): Exela had some amazing news this week, with the company purchasing up to 100 million shares (likely a third of the float) for $1 per share. Yes, the company is buying its own shares for $1, and yet the stock price isn’t even close to that!

Update (2/6/22): Exela looked like it would be hitting $1, but short sellers beat it down late in the week. I guess those idiots didn’t see the news that Exela is buying back its own shares for $1. The on-balance volume didn’t change very much, so you can be sure that normal people weren’t selling this stock.

Update (2/13/22): Here’s a very bullish article on Exela. I bought more shares this past week before even seeing this!

Update (2/20/22): There was a lot of momentum for Exela before the market crashed late in the week. On the bright side, Exela’s borrowing fee increased recently. With the company buying back shares, and institutions buying in, this one seems like a no-brainer.

Update (2/27/22): I can’t believe this was at 35 cents recently. RSI is currently at a middling 46, so there’s some room for the downside before the stock price rises. I’m waiting for a dip before I buy more.

Update (3/6/22): Exela is closing a preferred share exchange offer at $1.25. This will decrease the float by 30 percent. Exela continues to be severely undervalued.

Update (3/13/22): I was thinking about selling some of my Exela shares when it skyrocketed on Thursday. I did not, and the company plummeted Friday. Ugh. Earnings did not meet expectations, which is why the stock price fell. This could continue to drop back to 34 cents, which is where I’ll be buying.

Update (3/27/22): Exela announced that there will be a vote on a reverse split. This is extremely disappointing. I’m thinking about giving up on this one.

Update (4/3/22): The ATM offering is over, so this is expected to climb a bit. It really looked like it was going to move on Friday morning (it was at 50 cents at pre-market), but the red day ruined any chance of this rising. I’ll probably get out of this at the next surge.

Henrik Fisker’s EV company (just switched from SPAQ to FSR.) I think this will be $50 minimum one day, but may take a while. Fisker has a billion dollars, so this stock is worth $18.18 in cash. It’s extremely undervalued at $10.

Update (12/8/20): Fisker is now trading at $17.24. There’s still plenty of room for growth.

Update (1/19/21): Fisker has fallen a couple of bucks since my previous update. It’s a bit disappointing, but I’m still very bullish on the company.

Update (1/26/21): No change since last week. I’m still bullish here. Patience.

Update (1/31/21): Still no change. Fisker will be bringing lots of cars to the market in the coming future.

Update (2/7/21): No change. Fisker will skyrocket in the future, but not anytime soon, barring unexpected big news.

Update (2/15/21): If you didn’t believe in market manipulation, take note that there were 24,436 Feb. 12 calls at $19, and this stock closed at $18.99. Fisker closing above $19 would’ve meant that 2.4 million shares would’ve been bought, which would’ve been huge. Still, the outlook for Fisker is very bright, with Morgan Stanley issuing a $27 price target.

Update (2/21/21): It was disappointing to see this stock drop $1 last week, but it’s not a big deal. This company has huge upside for the long term.

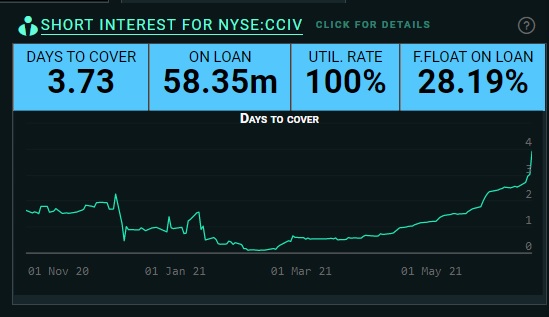

Update (2/28/21): Apple deal! Fisker exploded this past week, rising to $28.50 by the end of the week. This stock is still cheap, however, as Morgan Stanley has given it a regular price target of $40 and a bullish price target of $90. I can’t blame them, given that Apple manufacturer FoxConn will be producing their vehicles. Everyone who was chasing the CCIV crooks should be interested in Fisker instead.

Update (3/5/21): Fisker has fallen to $21 because of this crash. It hasn’t helped that shorts have been attacking this company because the cars won’t be coming for a while. And here I thought the stock market is supposed to look ahead… At any rate, this company has a bright future with Apple manufacturer FoxConn making the cars.

Update (3/14/21): The Bank of Norway added 1.1 million shares of Fisker in the mid-$20s. They are very well aware of Fisker’s potential once the cars begin to go to market. Be patient with this one. There’s enormous upside.

Update (3/21/21): Fisker is very undervalued again. It’s currently trading at 0.5x 2025 projected revenues. Nio, by comparison, is trading at 3.25x 2025 projections. Even just doubling it to 1x would bring Fisker into the $40s. My price target remains $50, though it may take a year to get there.

Update (3/28/21): Henrik Fisker announced a date when they’ll be showing off the Fisker Ocean production vehicle. That date is Nov. 17. That may seem like a while from now, but time will fly by quickly.

Update (4/4/21): No Fisker shares were borrowed from me (see CLOV for details.) This was surprising to me because automobile companies dropped because of the chip shortage. Fisker will rebound and eventually skyrocket in seen months.

Update (4/11/21): Fisker plummeted down to the 200-day moving average ($15.39), so this is likely its floor. RSI is 34 and Slo Stochastics are the lowest it has ever been:

This is a great buying opportunity, given the major potential of this company. There’s been lots of institutional buying at this range, so the sharks agree.

Update (4/18/21): Invesco bought nearly three million shares of Fisker at $15.03. Think this is undervalued right now?

Update (4/25/21): Fisker was beginning a nice reversal last week, but crashed on one of the days before rebounding. If you’re wondering what that was about, a short-selling scum put out a hit piece on Fisker, all while touting Tesla. The hit piece was nonsense, so it’s not a surprise that Fisker bounced back well.

Update (5/8/21): Tech stocks were shorted heavily these past two weeks, and Fisker is no exception. I’m sure Fisker will have another violent spike once they release more news. We still have to wait a bit until they release their product, but it’ll be coming eventually.

Update (5/16/21): Fisker and Foxconn had a nice announcement on Thursday where they promised to deliver an EV priced at $30,000. I expect the EV market to be on fire soon in the wake of the gas shortage.

Update (5/23/21): Moore Capital Management filed a 13G that shows they increased their share count in Fisker from 9.465 million to 11.828 million. Fisker had a nice week, climbing up into the mid $12s from the $10s.

Update (5/30/21): Fisker rose to the $13 range this week. I expect all good EV companies to do well in the near future because of the gas shortage.

Update (6/6/21): Fisker had a nice week, rising to the $15 range. I expect it to keep moving up because EV stocks figure to do well amid the gas shortage. It was also nice to see the borrowing fee move into the 3-4 percent range. That said, the borrowing fee was in the 60-80 range back in November and December, so we need to see that level for a huge squeeze.

Update (6/13/21): Fisker continued to increase in price this week, while the borrowing fee has remained steady. The higher this goes, the more shorts who are going to be underwater, so a squeeze appears to be brewing.

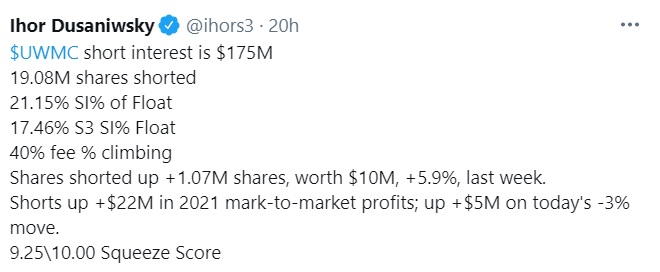

Update (6/20/21): If you have any doubts that Fisker is heavily shorted, check out the tweet from S3’s Ihor Dusaniwsky, which contain stocks not named AMC that have 100/100 short squeeze scores:

Update (6/27/21): Fisker rose at the end of the week because of its new index inclusion. The increased price will put pressure on shorts to cover, and there are many of them, as 30 million shares are on loan.

Update (7/4/21): I wrote last week that there 30 million shares on loan. There are now 40 million shares on loan, according to Ortex! An increase in 33 percent in such a short span is ridiculous, and it would explain the negative price action we saw this past week.

Update (7/11/21): Fisker dropped this week because so many of the small- and mid-cap stocks plummeted. However, it rebounded a bit on Thursday, indicating that it could be in the beginning of a reversal.

Update (7/18/21): EVs got crushed this past week, which would explain Fisker’s price drop. The RSI is now 37.6, indicating that it’s oversold, though we already knew that.

Update (8/1/21): Alliancebernstein bought 1.5 million shares of Fisker on June 30 at an average price of 18.25.

Update (8/8/21): Swiss National Bank bought 312,900 shares of Fisker. There were some other big buys as well. This one will pay off huge, but it’ll take some time.

Update (8/15/21): Good news, bad news this week. The good news is that Morgan Stanley raised its price target of Fisker to $40, with $90 bullish potential. The stock price rose as a result, but then plummeted when the CEO announced a $625,000 notes offering. This greatly pissed me off because Fisker has a billion in cash, so money wasn’t an issue for them. Nevertheless, the news dropped the price, but Fisker now has $625,000 more in his coffers than he did a week ago when this stock was the same price. It’s weird to think about it that way.

Update (8/22/21): Fisker’s very cheap, and if it drops to the low $12s, I will buy more. The price drop wasn’t warranted. Production will begin in a few months, which is when this stock could rise.

Update (8/29/21): Fisker never fell into the $12s, but I bought more. Why? Morgan Stanley bought 588,000 shares of Fisker, and Fisker is now more shorted than it has ever been:

I always liked Fisker as a long hold, but this is also turning into a major short squeeze play.

Update (9/5/21): Fisker is still heavily shorted, and the interest I receive for lending out my shares doubled on Friday, which was nice to see. It’s just a matter of time.

Update (9/12/21): Fisker looks primed for a squeeze. Take a look at the utilization, shares on loan and short interest, all of which have skyrocketed recently:

Update (9/19/21): Fisker dipped during the week, then rose on Friday. Here’s a very bullish article on Fisker from Seeking Alpha.

Update (9/26/21): Fidelity bought 1.16 million shares of Fisker as of July 31. Fisker shares has a nice bump late in the week because of a press release saying that Fisker vehicles will be displayed at the 2021 L.A. Auto Show.

Update (10/3/21): We had some good news:

When this goes to production, we’re going to have lots of people asking themselves why they didn’t buy when the stock price was in the low teens.

Update (10/10/21): I was talking to a long-time trader friend of mine who is also in FSR. We agreed that $13 is a bargain, but here’s what he said: “FSR long term will be great, but I think we can get an $11 price to buy more shares.” I think he’s right, given the state of this economy.

Update (10/17/21): The market makers wanted Fisker under $14.50 because that’s where a chunk of calls were. I don’t know how many times I have to repeat this, but by shares; not weekly options!

Update (10/24/21): Another growth stock that plummeted Friday because of interest rates. This is a fine price to buy, but it’s possible that we could see $11 at some point, as written two weeks ago.

Update (10/31/21): Fisker rose this past week for two reasons. First, it was a sympathy play to Lucid, which spiked to $37 because of their announcement that they will be delivering their vehicles soon. Second, there was some delta hedging because lots of future call options were being bought. Fisker is going to have a Lucid-type announcement soon, and the stock is still incredibly cheap right now.

Update (11/7/21): What a great finish to the week! Closing above $19 was a rare moment in which plenty of call options finished in the money. There might be resistance in the $19.40-$20.60 range, but there’s nothing but clear skies if we soar past that area.

Update (11/14/21): Fisker had another monster week, rising as high as $22.25 before consolidating in the $21s on Friday. It was a great week for EV stocks in general. It’s a reminder that Fisker has some amazing potential.

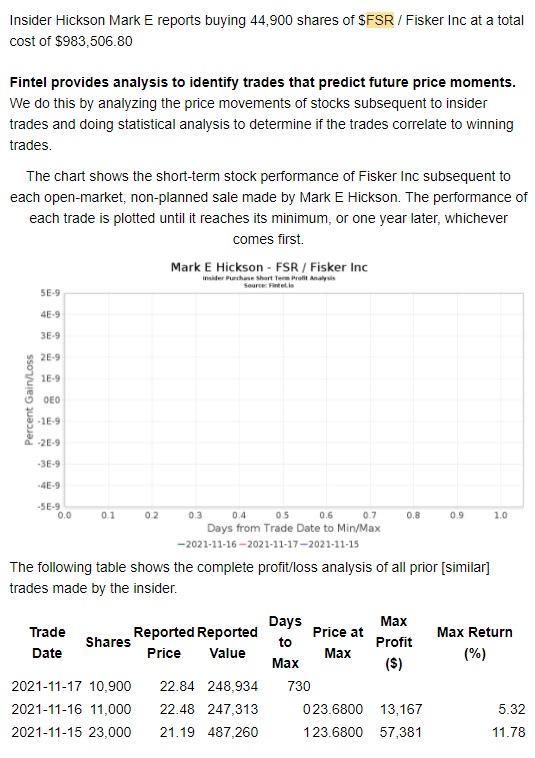

Update (11/21/21): Fisker dipped a bit this week, but given how bad the market was, it wasn’t too bad. EV stocks continue to be hot. More good news: Insider Mark Hickson bought 44,900 shares between $21.19 and $22.84:

Update (11/28/21): A down week for Fisker, but inconsequential in the long term. Production begins about a year from now.

Update (12/5/21): Fisker’s RSI is relatively high compared to the rest of the market (43). However, this could dip a bit because Lucid is going to fail to deliver the number of cars it promised.

Update (12/12/21): Fisker showed a sign of strength late in the week by not collapsing like everything else. There’s a lot to be optimistic about regarding this company with production beginning in 2022.

Update (12/19/21): Fisker doesn’t follow the market, so it was up on Friday. It’s just a waiting game for production to begin.

Update (12/26/21): I’ve seen some rumors that Fisker filed for a $2 billion shelf offerings. I’m not sure if it’s true or not, as the two sites that have posted that info look sketchy as hell. Shelf offerings are actually good because it means the company believes the stock price will rise, but it’s a bad thing in the short term because people don’t seem to understand the difference between shelf offerings and direct offerings.

Update (1/9/22): We’re in 2022, which means production will begin this year! If you look at Lucid’s chart, that’s the type of movement we should be expecting, except Fisker has 1/6th of the float of Lucid!

Update (1/16/22): Fisker has no revenue yet because their cars haven’t been released yet, but we can compare their market cap with Lucid’s, two similar companies where Lucid’s timeline is ahead of Fisker’s. Fisker’s market cap is $4.5 billion, while Lucid’s market cap is $62 billion. I don’t think it’s out of the question that Fisker’s stock price could 10x in the future.

Update (1/30/22): Fisker is near all-time lows, with its market cap now below $2 billion. It won’t be too long before this takes off. I purchased more shares this week.

Update (2/6/22): Fisker’s market cap is at $1.8 billion. This is a company with about a billion in cash alone. Many of the large-cap stocks have insane valuations – see Palantir for example – but the small and mid caps have the opposite effect where their valuations make no sense because they’re too low.

Update (2/13/22): Henrik Fisker teased something about the Super Bowl on Twitter. I wonder if this means there will be a Fisker commercial during the game.

Update (2/20/22): Fisker is another stock that was hot during the middle of the week, but fell because of war fears at the end of the week.

Update (2/27/22): I hope you caught the dip on Thursday when Fisker dropped to $9.99! I didn’t get more shares, unfortunately.

Update (3/6/22): I thought Fisker would fall as a sympathy to Lucid’s bad news last week. That didn’t happen, but Fisker plummeted anyway with the rest of the market. This is cheap at the moment, but could go lower because the RSI is 39.

Update (3/13/22): Fisker’s stock price waffled around the $11 range all week, with the RSI settling in at 42. I haven’t bought or sold shares for a while.

Update (3/27/22): Nothing new here. Production will begin soon enough.

Update (4/3/22): This was another stock that looked like it was going to run on Friday, but the red day ruined it. The good news is that we’re another month closer to production.

I’ve heard this described as the Michael Jordan of stocks. FUBO has millions of subscribers and will soon be integrating sports betting with their streaming abilities. This stock is like PENN/DKNG and ROKU had a baby. I think this could be $200 one day. (New 11/20/2020)

Update (12/22/20): Wow, I hope all of you bought this! It went as high as $51 on Monday.

Update (1/19/21): I sold some of my shares at $60, but I’m still holding a position. The stock is now 40-percent shorted, so it’s going to happen an awesome squeeze once they have some great news/earnings.

Update (1/26/21): FUBO is beginning to squeeze. I believe we’ll be back at $60 soon.

Update (1/31/21): The squeeze continues! FUBO is one of the stocks restricted by Robinhood, so once the nonsense ends, and the floodgates open, FUBO’s ascent should continue.

Update (2/7/21): I’m looking forward to seeing what FUBO’s short interest is during the next update. It’s likely still very high, and if so, we could see it squeeze to $100.

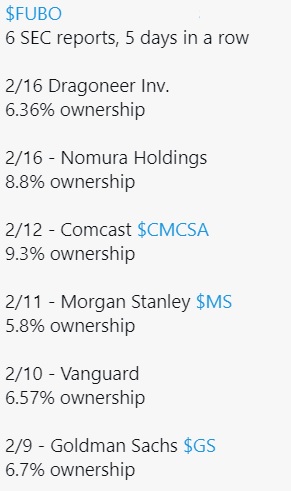

Update (2/15/21): There are currently 14,900 Feb. 19 $50 calls, so if the stock price finishes above $50 at the end of the week, this will skyrocket. That’s going to happen eventually anyway, as there’s a 50 million float with high short interest. Also, Goldman Sachs and Vanguard bought a combined nine million shares.

Update (2/21/21): We had some great news last week. Check it out:

Six institutions just gobbled up nearly half the float. FUBO is going to skyrocket in the near future. We should see $100 at some point.

Update (2/28/21): The stock price is now $35.30, which is an incredible bargain. Buy the dip! Remember, six institutions ate up half the float last week. They know big things are coming.

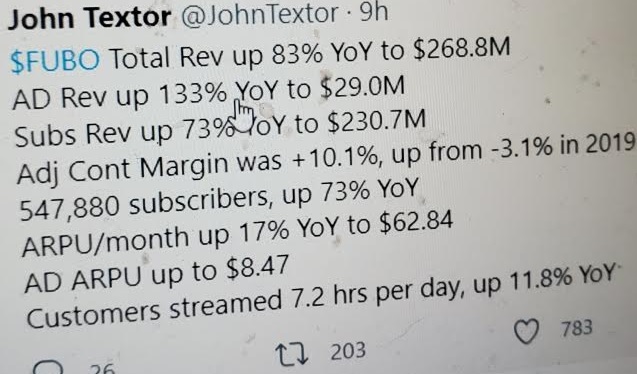

Update (3/5/21): Here are FUBO’s killer earnings. Tell me if that warrants a drop from $47 to $31:

Even better, look at institutional ownership:

Wow, 90-percent institutionally owned! The public float is less than seven million shares, and it’s heavily shorted. The big-money people know where this is going.

Update (3/14/21): FUBO dipped in after hours heading into the weekend. The reason was because the president of the company resigned, but he’ll be taking another role within FUBO. This drop isn’t warranted, so I’ll be buying dips this upcoming week. Remember, this is 90-percent owned by institutions, so the real float is very small.

Update (3/21/21): Will Meade, who worked for a billion-dollar hedge fund, shorted this stock when it was $60 several months ago. Meade just announced that he’s now long on FUBO. Meade was all over GameStop back in August when the company was in the $4s all month.

Update (3/28/21): What the shorts did to this stock on Friday was disgusting. Viacom plummeted, and the shorts used that as an excuse to sink this stock. We were able to pick up some incredibly cheap shares, however.

Update (4/4/21): No FUBO shares were borrowed (see CLOV for details), though I imagined that wouldn’t have been the case a week ago. FUBO appears to be in reversal, thanks in part to the news that FUBO will carry Marquee Sports Network. The two parties reached a deal on Thursday, which is a big deal. FUBO figures to have more Chicago viewership as a result.

Update (4/11/21): FUBO skyrocketed on Friday, moving from $20 to $25 before dropping to $23.31 during the sell-off. The big news was that FUBO will be broadcasting the next World Cup. Many people watch soccer for some reason, so this will obviously help the company.

Update (4/18/21): I can’t believe FUBO is under $20. So many institutions bought in at the high $20s, $30s and even low $40s. I don’t think they’re going to take a big loss on this promising stock.

Update (4/25/21): I still can’t believe this was under $20. It finally passed that number during the reversal, and it’s not a coincidence that this happened once naked shorting was curbed.

Update (5/8/21): Scumbags have been shorting this into oblivion recently. They’ll be sorry if Tuesday’s earnings report is positive. We’re looking to see if FUBO added lots of new customers. Needham’s Laura Martin speculated that FUBO would add two million customers per year. She has given FUBO a $60 price target.

Update (5/16/21): Stocks have been dropping on good, and even great earnings. FUBO’s earnings were incredible! This is why it shot up after being crushed into the teens by the shorts. FUBO is incredibly underpriced right now, and we’re beginning to see the borrow rate rise a bit. It just reached 4.7 percent, which is triple from where it was a week ago.

Update (5/23/21): FUBO spiked to $22 on Tuesday, but was shorted back down to $20. I would love to see the borrowing fee increase to squeeze these shorts out of their positions. The borrowing fee is now 2.3 percent, which is a drop from last Friday, but is still better than the sub-1 percent we saw for a while.

Update (5/30/21): What a rally for FUBO! It was having a great week until Friday, when it opened at $26 but then consolidated to the mid $24s. Still, it was nice to see this strong company bounce back after getting crushed the past couple of months.

Update (6/6/21): Former hedge fund PM Will Meade, who was once shorting this stock, predicted that FUBO will squeeze soon. The borrowing fee has begun inching upward, moving close to three percent from its previous sub-one range.

Update (6/13/21): FUBO was in the $30-32 range for most of the week, but the shorts dropped it to sub-$30 to close Friday because there were tons of expiring calls at $30. If the SEC actually cared about marketing fairness, they would do something about this blatant manipulation, but they’re either sleeping or siding with the enemy.

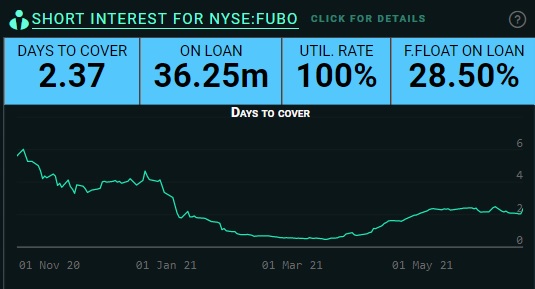

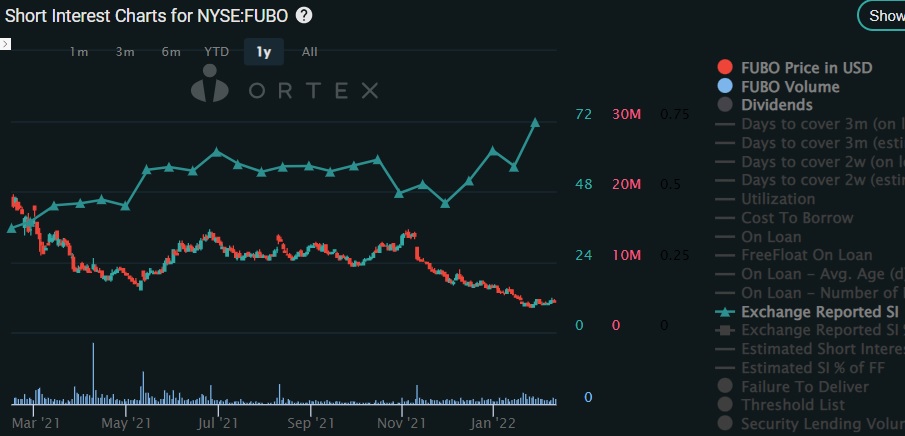

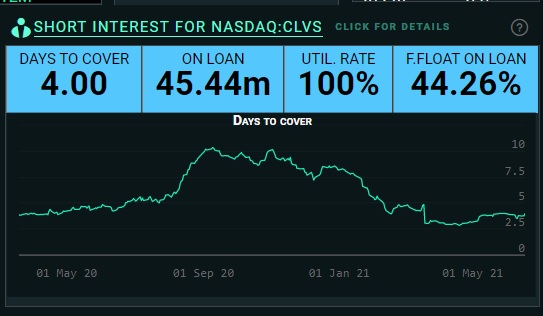

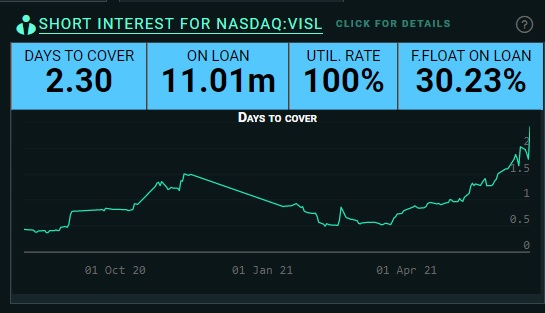

Update (6/20/21): FUBO is heavily shorted as well, so I’m sticking with it. Check out the Ortex data:

We have a stock 28.5-percent shorted with 36.25 million shares on loan and a 100-percent utilization rate. Those numbers will increase by Tuesday because the hedge funds killed a ton of $30 call options.

Update (6/27/21): FUBO had a great week, as some shorts covered. Despite this, there are still 34.8 million shares on loan, so plenty of dumb short sellers will still have to buy shares. You may have noticed that FUBO touched $35 on Friday, but was pushed down immediately. The hedge funds and market makers did this to kill $35 options.

Update (7/4/21): FUBO’s price decreased this week because of insider selling. David Gandler sold 88,642 shares at $35, which was very disappointing to see because this highly shorted stock had some great momentum going for it. Perhaps Gandler needed this money for taxes or emergency purposes, but had he waited, he likely could’ve gotten more money for his shares. I’m currently neutral on FUBO after this occurred. I still like the company, but bears might use this insider selling as FUD to drop the price.

Update (7/11/21): I sold some shares of FUBO, but only 20 percent of my shares. I’m still bullish on this heavily shorted company, but I thought it would drop because of the insider selling.

Update (7/18/21): FUBO’s earnings are coming up soon, and I can’t wait to see if their subscriber number beat expectations. State Street is optimistic. Thy bought 82,000 shares at an average price of $25.07, per a July 9 13F filing. If this drops a bit more – RSI is 39.7 right now – I’ll buy back the shares I sold.

Update (8/1/21): Alliancebernstein bought 196,000 shares of FUBO on June 30. It appears to be entering positive MACD territory on the chart, and the last time that happened, the price rose to $35.

Update (8/8/21): There were some big institutional buys for FUBO in recent filings, including six-figure share buys from Swiss National Bank and Rhumbline Advisers. FUBO, which is still very shorted, was upgraded to a hold by Zacks Investment Research.

Update (8/15/21): Good news, bad news. The good news was that FUBO crushed earnings. This prompted an increase to $31. That’s when the bad news arrived, which was a secondary offering. While this is bad for the short term, I think it’s bullish for the long haul because FUBO will have more money for purchases and expansion. No new shares were even issued yet. I believe this stock could drop a bit more, which will make this an interesting value play.

Update (8/22/21): I would have bought more FUBO this past week if I were eligible to do so. My loss expiry ends Sept. 6, so I will be buying more FUBO at this level. Remember, they destroyed earnings. This price is very cheap.

Update (8/29/21): Marshall Wace North America bought 410,000 shares of FUBO. Again, FUBO destoryed earnings, so it’s about to rise soon.

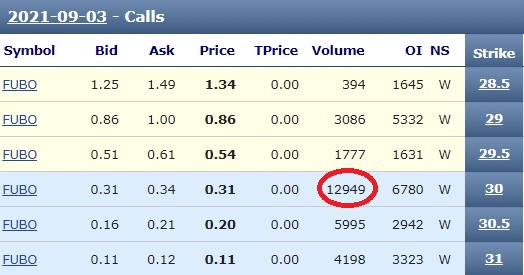

Update (9/5/21): FUBO spiked to $31 heading into Friday, as news of their sportsbook opening soon was released. Of course, the hedge funds couldn’t let this rise too quickly because of the call options:

This market is completely rigged, which is why FUBO closed the week just under $30.

Update (9/12/21): We had some exciting news this week, with FUBO partnering with the New York Jets. FUBO continues to be undervalued at this price because it never recovered from the selling induced by one of the hedge funds imploding. The only reason it finished below $30 is because market makers didn’t want these call options in the money:

Please, once again: Do. Not. Buy. Weekly. Options. The stock market is heavily manipulated and the SEC does nothing about it, so you will lose your shirt with weekly options.

Update (9/19/21): Utilization took a nose dive here as well. It’s down to 62 percent. I don’t understand how utilization is down across the board for most stocks. Perhaps Ortex changed how they report their data. It’s also possible that there’s disgusting manipulation happening once again. But that can’t possibly occur in the stock market, right?

Update (9/26/21): FUBO’s price sunk this week, making it a great value purchase at the moment. The FUBO Sportsbook app is now available in the app store, so you’d think that would have created some momentum for this stock.

Update (10/3/21): FUBO plummeted this past week. It’s truly baffling how low this stock is right now, given its immense potential. All growth stocks have taken a major hit since March, but they will recover at some point.

Update (10/10/21): This stock rose in the middle of the week because FUBO and the Cleveland Cavaliers agreed to a multi-year partnership. Of course, FUBO fell Friday along with the rest of the market. A price of $24 is a steal.

Update (10/17/21): A week after FUBO signed a deal with the Cavaliers, FUBO Sportsbook was named authorized gaming operator of NASCAR. This is why the stock rose late in the week. It’s still far below levels before it plummeted during the margin call sell-off earlier in the year.

Update (10/24/21): This growth stock took a hit Friday along with the rest of the market, which is a shame because it reached $30 earlier in the week. FUBO has had so much great news recently, however, that’s bound to take off soon.

Update (10/31/21): There were plenty of FUBO purchases per the Fintel page. I didn’t see anything crazy, but this is still bullish as we continue to see higher lows.

Update (11/7/21): FUBO had a great week, hitting resistance at $35. Earnings are on Tuesday, so hopefully we get a great report!

Update (11/14/21): FUBO had a great earnings report. Revenue beat with $156.7 million over the estimated $143.55 million. EBITDA beat expectations as well. Total subscribers is now close to a million. Despite this, FUBO plummeted from $33 to $24. I believe this is a combination of factors. Tax selling is definitely a contributor. Also, some didn’t like the purchase of Molotov for $190 million. Still, FUBO is incredibly underpriced at the moment for its huge growth. I sold some shares at $33 for taxes (not too many, unfortunately), and I’ll be re-buying in the mid $20s once the 30 days are up.

Update (11/21/21): Man, I wish my 30-day period was expired so I could buy more shares at this level. I can’t believe how cheap FUBO is at the moment.

Update (11/28/21): I was really kicking myself for not being able to buy at $19 on the 23rd. This price is absurd, but as mentioned in the DraftKings write-up, the entire sector is down.

Update (12/5/21): There’s no reason FUBO should be this low. RSI is 24. I’d buy more if I weren’t locked out of this for 30 days.

Update (12/12/21): FUBO is dirt cheap right now with an RSI of 33. It fell along with the entire betting market and should bounce back when the rest of that sector does.

Update (12/19/21): FUBO is another heavily oversold gambling stock. Its RSI is 31. I will put in buy orders when my tax-selling lockup is expired.

Update (12/26/21): FUBO made a nice move from $15 to $17 this past week, but continues to be oversold. The entire betting sector is down, but that could change soon with bowl season and the NFL playoffs upon us.

Update (1/9/22): I was able to get back into FUBO at $13/$14 after tax-loss selling. We currently sit at 12-month lows. I expect FUBO to rebound along with the rest of the gambling sector.

Update (1/16/22): As mentioned in the DraftKings entry, the entire betting sector is undervalued. As you can see above, I have an open order for more FUBO shares.

Update (1/30/22): FUBO’s market cap is down to $1.5 billion even though annual revenue is a third of that. I put in a $7.99 buy order for FUBO that didn’t fill yet.

Update (2/6/22): FUBO’s market cap is now $1.31 billion. Its earnings are on Feb. 23, so maybe that’ll make people realize what an incredible value this stock is right now.

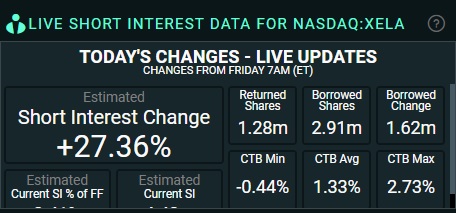

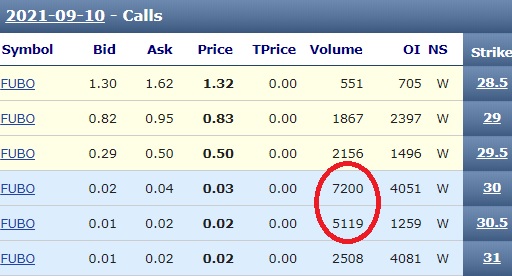

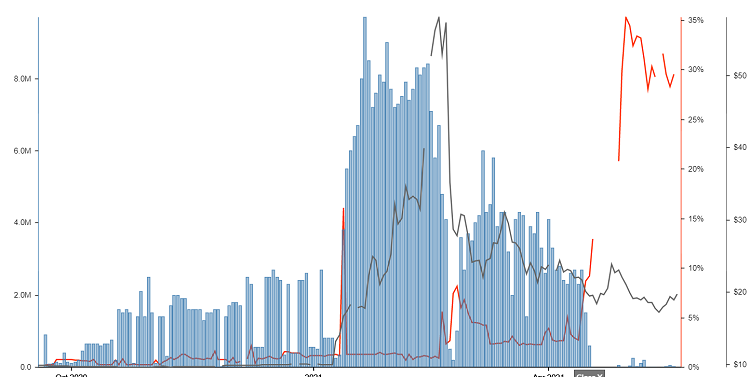

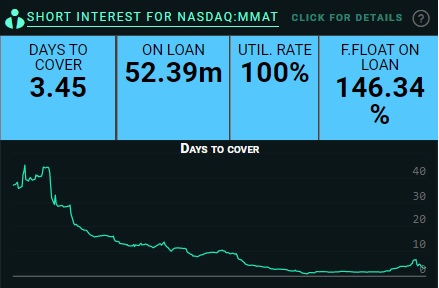

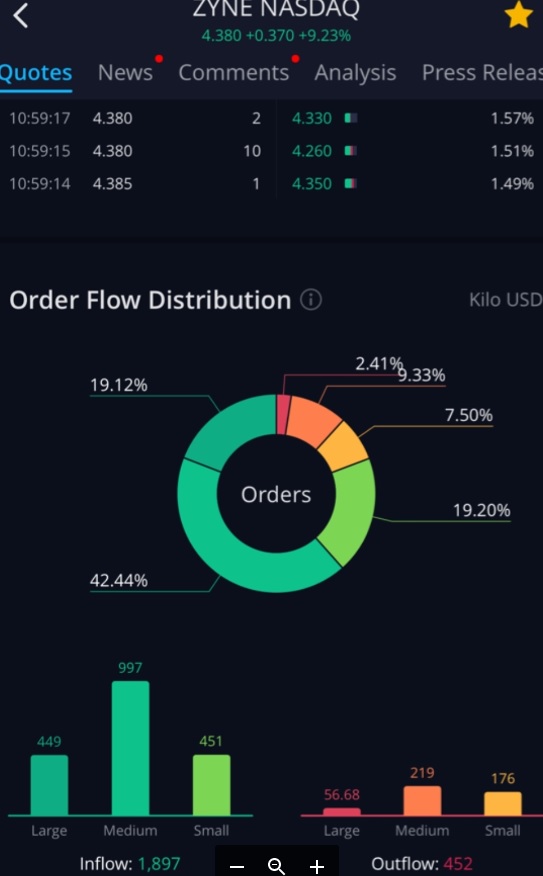

Update (2/13/22): FUBO’s short interest is now the highest it has ever been:

Hopefully the low borring fee rises to put pressure on these a**hole shorts.

Update (2/20/22): FUBO dropped Friday because of DraftKings and Roku’s earnings. It’s not cheaper than when Zack Morris recommended it last fall.

Update (2/27/22): FUBO’s earnings were this past week. EPS missed by 2.6 percent, but revenue beat by 8.3 percent. The best news is that FUBO now has a record 1.13 million subscribers. I don’t think EPS missing is meaningful because FUBO is a growing company, and it’s using its money to obtain more subscribers. That’s what growing companies do.

Update (3/6/22): As a reminder, FUBO was $35 five months ago. What happened that its share price was reduced to $7? Nothing, that’s what. In fact, FUBO reported a record number of subscribers. This company is a steal right now, as its RSI is only 32.6.

Update (3/13/22): I bought more shares at $6.99 on Friday morning, thinking I got a great deal. Whoops. FUBO closed at $6.60, but the RSI is 31, so we’re in the oversold buy zone.

Update (3/27/22): As mentioned under DraftKings, the entire gambling market has been in a huge downtrend. It’ll have to come to life at some point. The last time the RSI has been above 50 on this ticker is November!

Update (4/3/22): It’s a bad look for FUBO that they didn’t air the Final Four. That, combined with the downtrend in gambling stocks, has caused this to fall further. I think this could continue to drop.

How can you not like a company called Thunderbird, which was the toughest boss in Zelda II? OK, this is Thunder Bridge and not Thunderbird, but still. At any rate, here’s a semi-conductor play. This is intriguing because there’s a global shortage in semi-conductor chips, so there could be lots of interest in this one. There was a $1.2 million buy at $14 on this stock, so someone with a ton of money agrees. This stock is heavily shorted (26.64%), so this one will shoot up when we get some news. (New 1/19/2021)

Update (1/26/21): This dipped a bit this past week, but that’s a good thing. There’s some serious consolidation happening. This company has very high potential.

Update (1/31/21): Consolidation and shorting. This stock has dipped, but there’s a $10 floor because it’s a SPAC. This company has enormous potential.

Update (2/7/21): No update. Buy the dip!

Update (2/15/21): The government has acknowledged the shortage of semiconductors, which caused the stock price to rise on Thursday. It dropped back down on Friday. The stock is still criminally underpriced and heavily shorted.

Update (2/21/21): We’re still waiting an announcement from the vice president’s administration on the shortage of semiconductors. Thunder Bridge is extremely underpriced right now.

Update (2/28/21): Several car companies had to shut down production due to a lack of semiconductors. I’m not sure why the government hasn’t asked for companies like THBR to ramp up their production, but it should happen soon.

Update (3/5/21): Vice President Joe Biden will talk about semiconductors one day, mark my words. He’ll have to wake up from one of his five daily naps, but I’m confident he’ll get to it sooner or later. Until then, anything under $11 is a steal.

Update (3/14/21): Thunder Bridge eclipsed $12 at one point on Friday, ultimately finishing at $11.79. Are people finally beginning to realize that semiconductor stocks are undervalued because of the shortage? This company has received $20 price targets, which isn’t high enough, as far as I’m concerned.

Update (3/21/21): Roth starts THBR at Buy with a price target of $20. That’s nice, but $20 is still too cheap!

Update (3/28/21): Nio has stopped production due to a chip shortage. With that in mind, how has this chip company bottomed out? It makes no sense!

Update (4/4/21): Jim Cramer talked about Thunder Bridge on his show, which sparked this stock to climb up to the $11 range. I still don’t understand why this hasn’t gotten more attention, given the chip shortage. Oh, and none of my THBR shares were borrowed.

Update (4/11/21): It’s crazy that this stock price can’t hold. Every time it looks like it’s making a move, it comes crashing back down to the low or mid $10s. Yet, there are two legitimate price targets of $20 and $17 on this stock.

Update (4/18/21): Another SPAC that is getting crushed. Everything is cylical, so THBR will have its day.

Update (4/25/21): THBR is one of many SPACs that had to re-file papers because of the warrants rule change, stemming from the CCIV fraud. We’ll see what happens, but there’s no downside here because THBR can’t go below $10.

Update (5/8/21): Let’s give a shout out to the CEO of this company for delaying the merger; otherwise, the stock price would’ve gone below $10. With the bear market for SPACs coming to an end soon, THBR could run eventually.

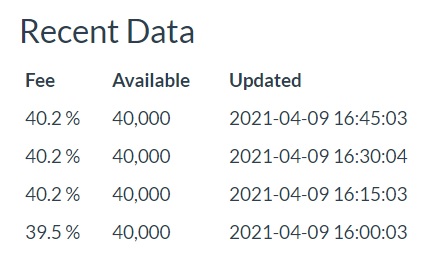

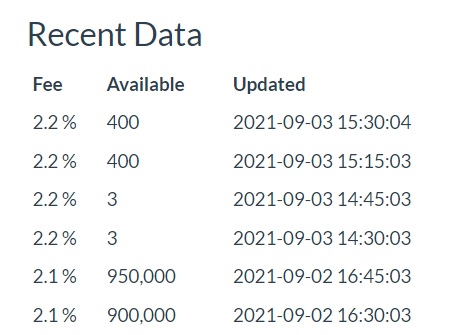

Update (5/16/21): We have a nice IBorrowDesk chart on THBR. Shares to borrow are disappearing, and the borrow fee skyrocketed from 0.5 percent to 7.9 percent. The short-selling scum have pinned down this stock to $10 – it can’t go lower because it’s a SPAC – but perhaps this is a sign that it’s close to finally moving.

Update (5/23/21): THBR’s borrowing fee is down to 2.2 percent, but it’s still much better than the 0.5 we saw earlier. Shares to borrow are lower than before as well. I think this stock will squeeze eventually, but we might be a couple of months away from that.

Update (5/30/21): Thunder Bridge is being manipulated so much, it’s ridiculous. I’d love to see the borrowing fee skyrocket to make these scumbags pay, but it’s still rather low.

Update (6/6/21): Nothing new to say this week. This continues to be highly manipulated. The merger is coming soon, so perhaps that will spark some price movement.

Update (6/13/21): After barcoding for months, THBR merged into Indie Semiconductor. The price actually moved for once, though not very drastically. Car chip stocks should be going through the roof right now, but this has been held down by scumbag manipulators. The good news is that the borrowing fee has risen to 13.2 percent, so there could be a squeeze on the horizon.

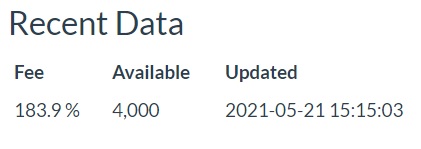

Update (6/20/21): Indie just had its merger, so I’m not seeing any short data on it from Ortex. However, iBorrowDesk is showing just 4,000 shares available to short, so this could be heavily shorted.

Update (6/27/21): We still don’t have data from Ortex – and likely won’t for a couple of months – but it’s a good sign that the borrowing fee has reached double digits. Given the chip shortage and increased borrowing fee, we should see the stock price rise soon.

Update (7/4/21): There’s not much to say this week. There’s a semiconductor shortage, and this company makes them. I don’t understand why this stock price is less than $10.

Update (7/11/21): Indie was trending on Stock Twits all day Friday, when it rose nearly 10 percent. This upcoming week should be nice.

Update (7/18/21): There were no shares available to short for several hours on Friday, according to iBorrowDesk. Indie is extremely underpriced right now. Barring dilution, this could be $100 stock in a few years.

Update (8/1/21): Indi earnings are on Aug. 10, so hopefully we get some good news in nine days!

Update (8/8/21): The administration that believes it is in power is stressing EVs, and Indie’s earnings are in two days. Here we go!

Update (8/15/21): Indi beat revenue but lost on earnings. That’s not a big deal because this is a 2- or 3-year play.

Update (8/22/21): Holy crap, look at these buys!

George Soros bought 2.5 million shares. Luxor and Ghisallo each bought a million. Summit bought two million. Bamco bought 1.74 million. And yet, this price is near an all-time low? WTF. This company makes semiconductor chips, and there’s a chip shortage. Hello!? I bought more shares this week, if you couldn’t tell.

Update (8/29/21): Here’s another seven-figure purchase: Barons Investment Funds Trust bought 1.25 million shares of Indie.

Update (9/5/21): No new filings were released, but we had some positive price action throughout the week. We should be in the teens soon.

Update (9/12/21): Indi had a nice close to the week. There were no new filings, but we probably won’t see any until October because that’s when the Q3 purchases will be revealed.

Update (9/19/21): Motley Fool published a short-term bearish article on Indie, yet George Soros bought seven figures’ worth of shares. I’m sure they know more than he does.

Update (9/26/21): My INDI shares were lent out for the first time in quite a while. This means that utilization is rising, which is good news for us.

Update (10/3/21): There must have been a major buy this past week because INDI finally broke out of its $10-11 trend and rose to $12. Again, George Soros bought 1.5 million shares of his company.

Update (10/10/21): INDI is the type of company that won’t collapse during a crash because they’re going to make so much money selling semiconductor chips, which are in very high demand. Soros knows what he’s doing; he helped orchestrate this economic collapse, which is why he bought 1.5 million shares of this company.

Update (10/17/21): This is a long hold, so there are weeks in which I won’t have a substantial update. This is one of those weeks.

Update (10/24/21): Nothing to update again, save for the great Thursday we had in which we ran up to $12.30. This stock is still incredibly cheap.

Update (10/31/21): INDI had a nice week, rising into the $13s. Even better, Fidelity bought 435,000 shares of INDI, effective on Aug. 31.

Update (11/7/21): We had some more big INDI buys. Tygh Capital bought 454,000 shares, while Sycamore Asset bought 255,000 shares.

Update (11/14/21): INDI’s price action was great this week. Here’s another reason to be positive: Vanguard bought 1.795 million shares of INDI, effective Sept. 30.

Update (11/21/21): INDI had a nice week, especially when considering the horrible stock market. There are no new significant buys to report, unfortunately.

Update (11/28/21): INDI had a green day on Friday, which is telling. The stock price dropped a couple of bucks during the week, but that only allowed the RSI to cool off. The RSI is now 49, which makes INDI a compelling buy again.

Update (12/5/21): Ah, the power of George Soros. INDI’s stock price didn’t fall that much compared to the rest of the market. INDI is 30th on the Fintel Short Squeeze list (you need a subscrption to see it, but I can show you the proof here):

Update (12/12/21): PIPE selling knocked this price down to $12, and I’m kicking myself for not knowing about it. Had I known the date, assuming it was even available to the masses, I would have sold and then re-bought at $12. Nevertheless, this is a great price to buy into this company.

Update (12/19/21): The PIPE selling really hurt this stock. It now has an RSI of 36. I find it hard to believe George Soros is not going to make a ton of money on this stock.

Update (12/26/21): Someone is making a bet against George Soros because they shorted this stock. Short interest and utilization are high:

INDI is now 70th on the Fintel short squeeze list.

Update (1/9/22): We’re near levels at which George Soros purchased 2.5 million shares. This is a play for the long haul.

Update (1/16/22): Like Fisker, Indie is a great investment for the future. This is the buy zone.

Update (1/30/22): Indie’s market cap is now under $1 billion, making it very cheap. Blackstone purchased 200,000 shares of Indie.

Update (2/6/22): This stock has become highly shorted. FinViz has the short interest at 36 percent. I don’t understand why short sellers are shorting a stock in which George Soros invested at a higher price than it is currently.

Update (2/13/22): FinViz has reduced INDI’s short interest to 11.4 percent. I’m not sure what happened, but it’s still a great value.

Update (2/20/22): Earnings are on Tuesday. With all the institutional money in this stock, I expect good news.

Update (2/27/22): I missed this a couple of weeks ago, but George Soros bought one million more shares, giving him 3.5 million shares. That’s the good news. The bad news is that a Google search is saying that Indi missed on revenue and EPS. This is not true. Revenue beat and EPS was as expected. Guidance was solid as well. There’s plenty to be bullish about with this company.

Update (3/6/22): Nothing new here. RSI is 38.7, so there’s still a bit of room to the downside to create a great buying opportunity.

Update (3/13/22): I keep waiting to see something that says George Soros sold his shares, but no such filing has been made. I have to think this will explode eventually.

Update (3/27/22): Nothing new to add. The RSI has moved close to 50, but the stock price hasn’t moved very much.

Update (4/3/22): Earnings were announced for May 12. Perhaps we’ll finally have some movement then.

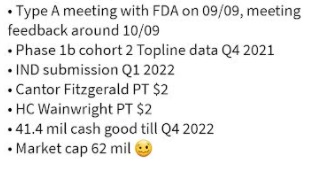

I’m introducting iSpecimen as a new play this week. This is a shorted stock with a very low float of 6.96 million shares. Its market cap is $65.4 million, and according to some of their recent filings, they have revenue of $350 million coming into the company. Despite this, the stock has been shorted down from $28.98 to the high $5s/low $6s. The shorts are paying an expensive price to do this right now. The borrowing fee is 114.8 percent! With the short thesis dying from the increased revenue, and the expensive price to maintain the shorts, this company could squeeze violently. (New 1/14/2022)

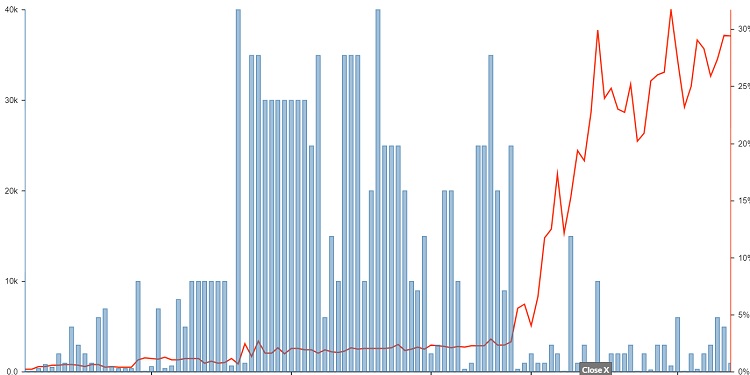

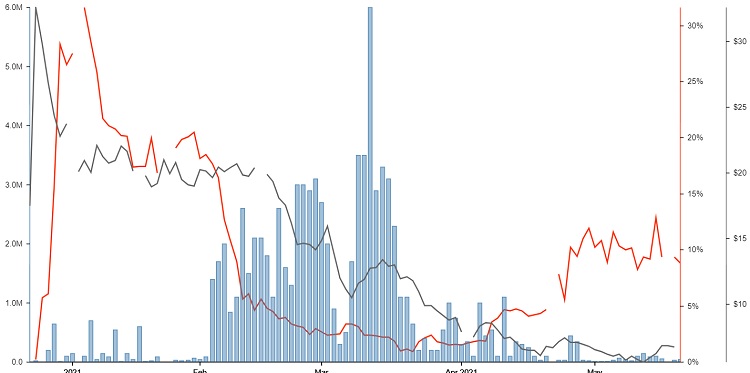

Update (1/30/22): Here’s another extremely manipulated stock. Take a look at the on-balance volume and the lack of red volume days:

Update (2/6/22): ISPC had a nice close to the week, finishing above $5. There’s still a long way upward to go, as this was trading for more than $25 at one point in December.

Update (2/13/22): ISPC dropped a bit this past week, but that’s fine. The float is only seven million shares, so it could explode at any moment.

Update (2/20/22): This is the lowest ISPC has ever been. There’s nowhere to go but up, right? Remmeber, this is a low float with a high borrowing fee.

Update (2/27/22): I picked up more shares of ISPC when the RSI reached about 30 on Wednesday. Despite the price drop, the on-balance volume hasn’t fallen at all.

Update (3/6/22): ISPC hit $4.24 this past week, but fell to $3.83 to close Friday’s trading. On-balance volume remained very high. RSI is 37.5, so you can wait a bit to add more shares.

Update (3/13/22): ISPC rose to $4 earlier in the week, but closed at $3.88. On-balance volume remains high.

Update (3/27/22): ISPC finished at $4.04 this past week, so perhaps we’ll finally have a leg up next week.