I’ve been trading stocks since 2009, but really amped up my activity once the pandemic started to offset advertising losses. I made several people millions – or so they’ve told me – with the work we did with GameStop, which I’ve saved for posterity at the bottom of the page. I told people to buy GameStop when it was trading at $8 per share. It eventually squeezed to $470 before Robinhood took away the buy button on Jan. 28, 2021. GameStop, however, is still doing quite well. The company, which is now profitable, did a 4/1 split, so the $22 price per share you see is really $88. So, if you’ve held this entire time, you’re still up 11x. Hopefully you’ve sold some covered calls in the meantime.

I used to be a pure long investor, but my tune has changed. I used to hate short sellers because of the shady crap they were trying to pull with GameStop, but I’ve come to loathe sketchy CEOs even more. Adam Aron, in particular, is an evil human being who tricked his investors on multiple occasions in order to use them as exit liquidity on malicious offerings that derailed potential squeezes. The CEO of BBIG is another one.

I’ve come to realize how important short selling is because it really holds these crooked CEOs in check. I don’t like purely shorting something because there’s infinite downside, but I’ve been buying puts on terrible companies that have no money and happen to be pump-and-dump dilution machines.

I’m going to list some poorly run companies for which I’ve bought puts, but I’d like to talk about GameStop because I’m still heavily invested in the company.

Long: GameStop ($GME)

GameStop’s transformation has been incredible. The company was rumored to be on the verge of bankruptcy in the early stages of 2020, but something short sellers didn’t take into account was that Covid would force people to stay at home and play video games. GameStop’s online sales skyrocketed as a result. The PS5 was also being released at the end of the year, so that was my initial interest in the company. I thought I could buy shares at $4 and sell them at $10-$15 in less than nine months. But on came Ryan Cohen, who completely revitalized the company.

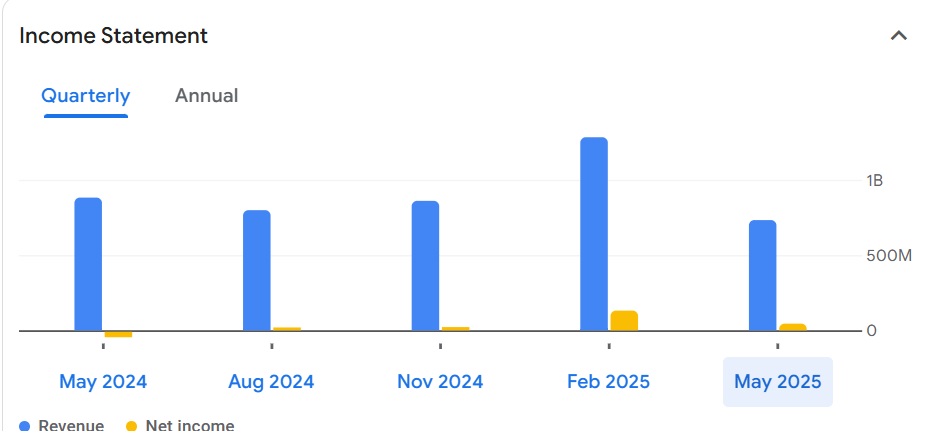

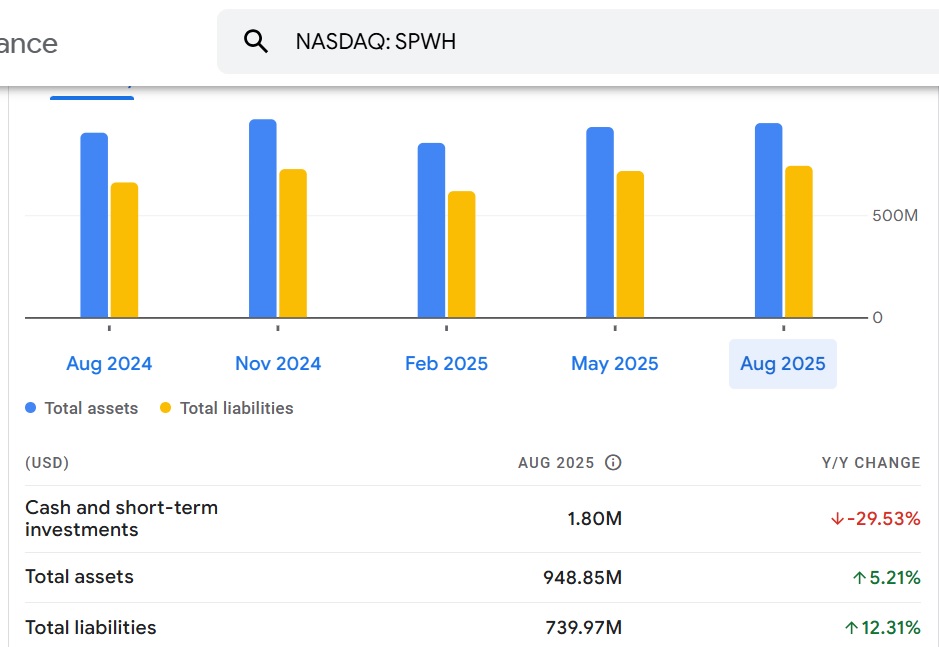

GameStop, which was never profitable five years ago, has had four consecutive profitable quarters:

Yellow is the key color here, and this shows that GameStop has been profitable since the middle of 2024. GameStop has also raised nearly $10 billion in cash and possesses no real debt outside of $2 billion or so in convertible bonds due in 2031. The company possesses more than half-a-billion dollars in Bitcoin as well, and it will likely purchase more.

I’m discussing GameStop now because its earnings are on Tuesday, Sept. 9. This previous quarter will incorporate Switch 2 sales, so this could be GameStop’s best quarter yet.

Something I found interesting is that GameStop usually runs up to earnings and then drops in a classic “buy the rumor, sell the news” dynamic. GameStop hasn’t moved at all in the past several month, however. It’s been pinned between $22.50 and $23.50 for what feels like an eternity. This might be an indication that it’s set to rip in the wake of positive earnings news.

I have both shares and calls expiring on Oct. 17 ($24 strike price).

Short: EOS Energy ($EOSE)

I like to check filings for potential reverse splits in the future. Reverse splits are like nails in a coffin for any company. Stocks almost always plummet following a reverse split because investors fear that dilution is around the corner.

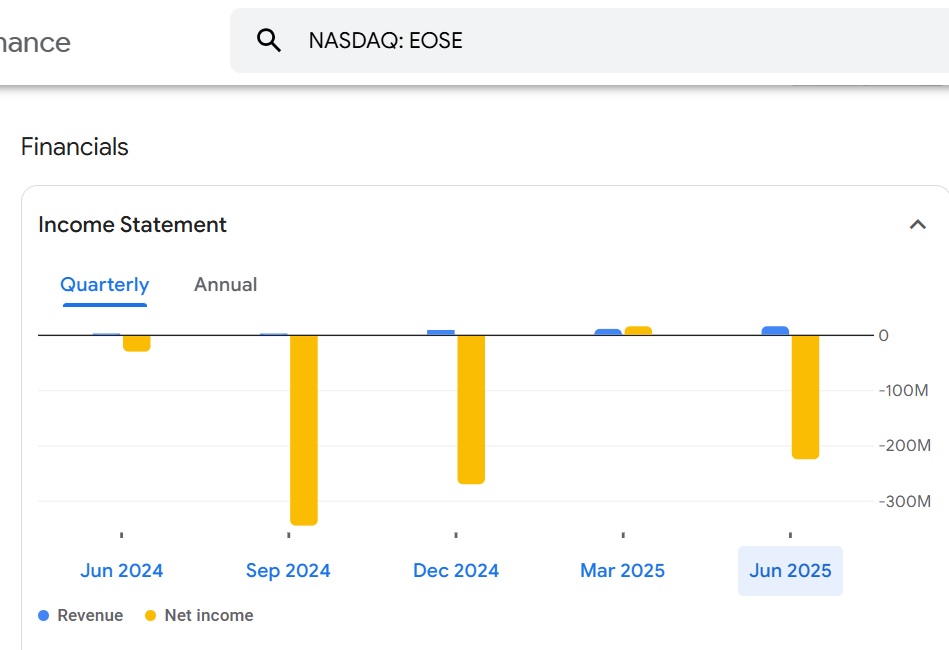

EOS Energy approved a reverse split a year ago, but has never implemented it. My belief is that they’re waiting for dilution to tank the stock. And EOS will have to dilute. Just take a look at their financials:

This company, which has lost $200 million or more in three of the previous four quarters, has nearly three times more debt than assets. That’s not good. With the funds drying up, dilution is certainly on the way, which would explain why their director sold $395,000 in shares last week. The rats are fleeing the ship, and those who still own shares will be left holding the bag.

I have $7.50 puts expiring on Jan. 16. If this stock plummets to $4, which was the share price back in May, our puts will triple in value. Dilution could even take it lower than $4.

Short: Faraday Future ($FFAI)

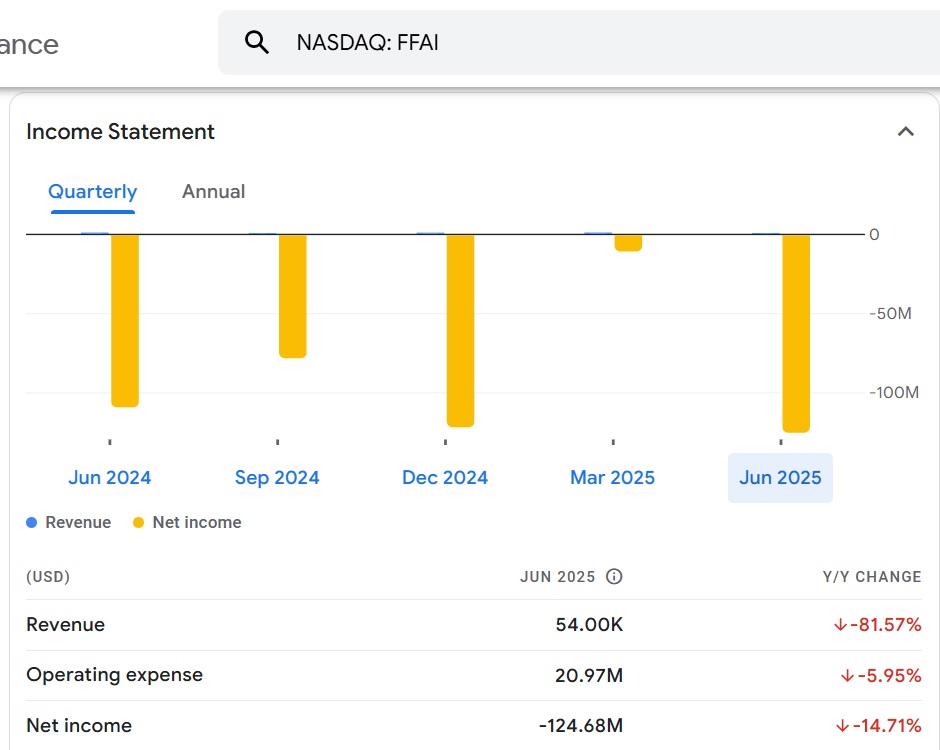

Faraday Future is a stupid company whose sole purpose is to extract wealth from dumb investors. I don’t think it actually does anything because there is no revenue. Seriously, this company doesn’t produce any money. Look:

OK, OK, you got me. They made $54,000 last quarter. Whoop dee doo. That’s troubling, considering that they’ve burned through $100 million or more in three of their previous five quarters.

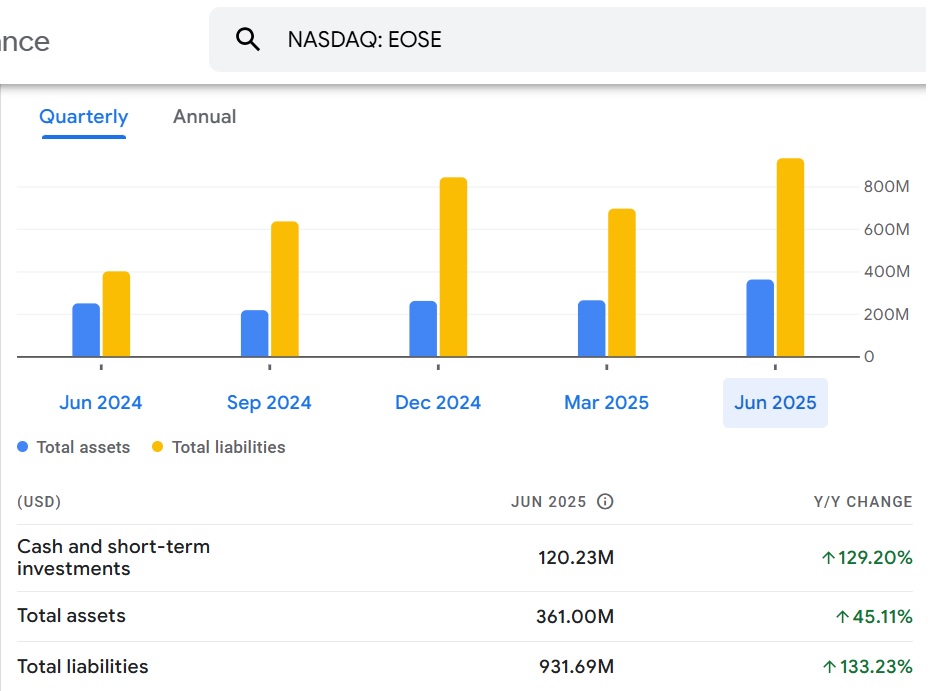

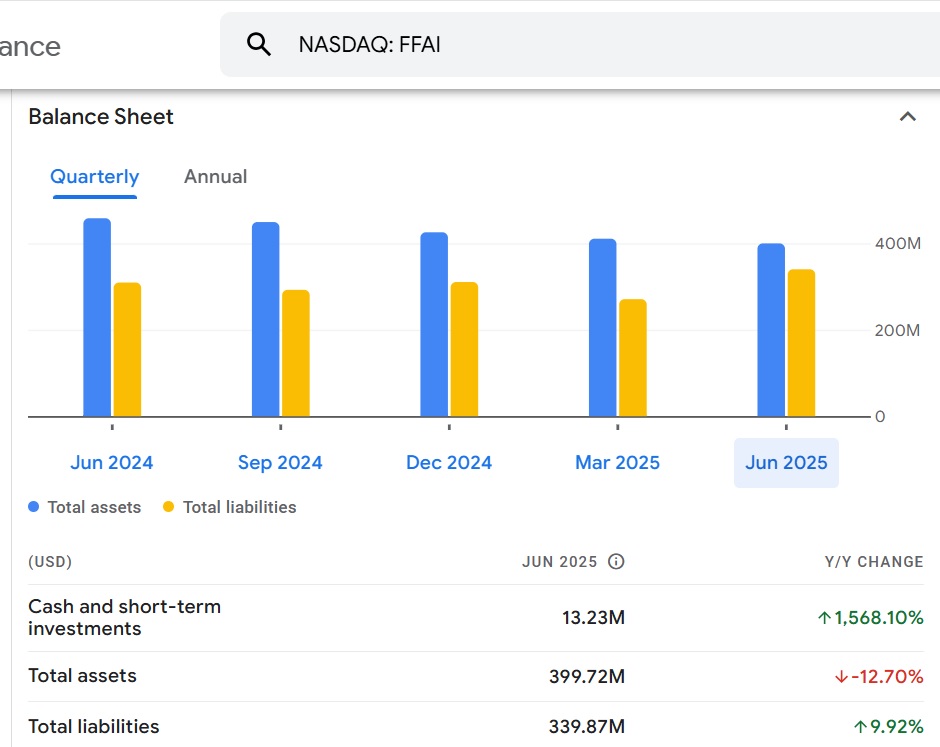

It’s no secret that FFAI needs money. They have just $13 million remaining, and they have nearly $340 million in debt. Take a look:

A company that routinely burns through $100 million can’t survive with just $13.23 million remaining. Dilution is coming, and then a reverse split because the stock will be under $1 by then.

I’ve held $3 puts expiring on Sept. 19 for a few weeks, and they are up 47 percent. I plan to roll them to a $2.50 strike price, expiring between November and January.

Short: Lucid Motors ($LCID)

Exciting stuff is happening at Lucid. They just closed a $300 million deal with Uber, and they aired a fancy commercial during the Chiefs-Chargers game. Awesome.

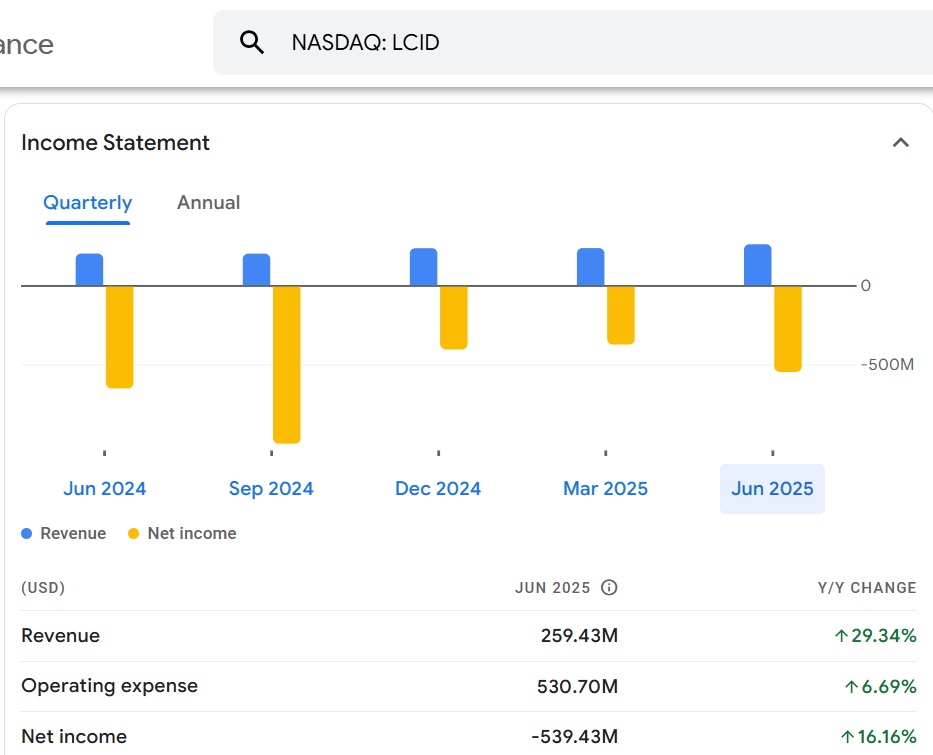

Except, it’s really not that awesome. The $300 million deal with Uber means nothing, considering how much cash Lucid burns through each quarter:

Lucid has lost $339 million or more in each of the previous five quarters, so that $300 million deal won’t even last them three months. Plus, they undoubtedly spent a pretty penny on that commercial they couldn’t afford.

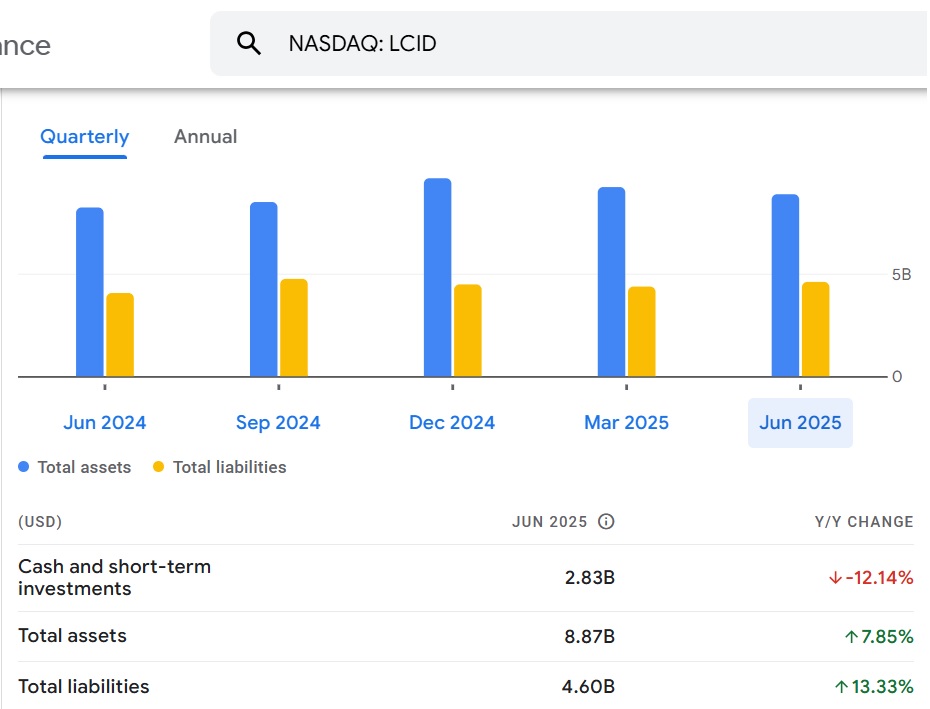

It’s just a matter of time before Lucid dilutes because they needed way more than that $300 million from Uber. Take a look:

At first glance, $2.83 billion in cash may seem like a lot, but that will sustain for about six quarters at the current cash burn. And the rising debt will soon become an issue.

For this one, I’d maybe wait until the excitement from the Uber deal subsides and people remember that this company is a turd that sells EVs, which are desired only by hipster losers. I had $18 puts expiring on Oct. 17, but I bought a $22 call with the same expiry as a hedge for this news. I think we can wait on this one, but I’ll be watching as the cash dwindles.

Short: Sportsmans Warehouse ($SPWH)

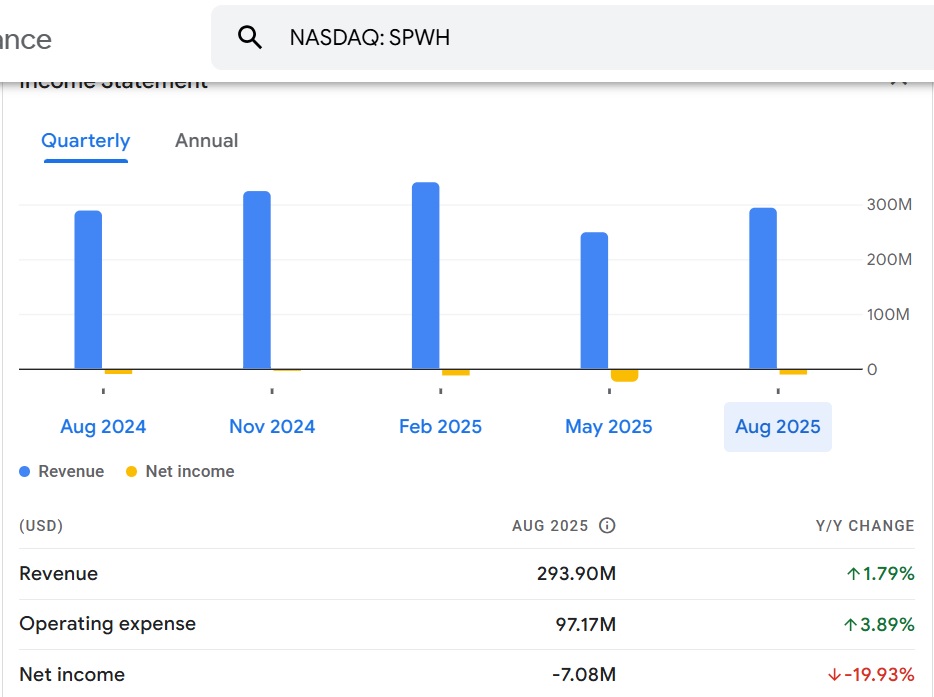

This company is starving for money. If you’re long and don’t want to believe me, the numbers don’t lie:

This company has not made a profit in at least five quarters, and it has just $1.8 million remaining. It lost $7 million last quarter, so how are they going to survive the next month without raising cash? Even the CEO said that the company needs money during the earnings conference call!

Unless a magic fairy carrying a briefcase full of money appears at SPWH headquarters, we’re going to see dilution. And given that this company is so close to the $1 threshold needed to stay listed on NASDAQ, we will likely see a reverse split in the near future.

I currently have $2.50 puts expiring on Oct. 17 and Jan. 16. Puts here are mysteriously cheap, so we might be able to make a killing on this one. If the share price drops to $1, our January puts will 6-8x in value!

I’ll be adding more companies in the future. For now, enjoy the trip down memory lane.

Former GameStop Due Diligence:

GameStop? The video game store? Yes, GameStop.

If you haven’t been following it at all, you might assume that GameStop is on the verge of bankruptcy. You may think of it as the next Blockbuster. This thesis couldn’t be further from the truth. GameStop has done a great job of re-branding itself. Its online sales have skyrocketed, showing an increase of 800 percent in Q2 (source.) GameStop now provides same-day delivery, giving it an edge over Amazon and Wal-Mart. It revamped its Web site and app. It’s on pace for a billion dollars in e-commerce in 2020.

If that’s not enough for you, Ryan Cohen has bought 10 percent of the company. Cohen was the former CEO of Chewy, and he sold it for $3 billion. Chewy became a great company because of its retail/e-commerce hybrid model, and Cohen plans on transforming GameStop into a similar type of entity to compete with Amazon like Chewy does. In fact, Ryan Cohen sees GameStop rivaling Amazon long term. That may sound odd at first, but think about it: Cohen’s former company, Chewy, rivals Amazon in its sector. With same-day delivery and an already-established brand, GameStop can rival Amazon in the gaming and computer accessories sector.

Cohen’s plan is why GameStop has been closing plenty of stores lately. The plan is to shut down the least-profitable establishments and keep the most-profitable ones open while increasing an online, same-day delivery presence. Cohen is extremely selective in his investments, so his purchase of GameStop really turned some heads. I was already an investor, but that 10-percent stake made me even more convinced that the stock will skyrocket.

Cohen’s investment is far from the only reason to be bullish on GameStop. Other reasons include:

With all of these positive factors, GameStop must skyrocket. It’s a guarantee because its short interest, as of this writing, is way above 100 percent, with $70 million shares shorted and $48 million public float. This means that every single share of GameStop has been shorted, plus numerous extra. Short sellers did this because they thought bankruptcy was inevitable, but that thesis has been debunked. GameStop has nearly a billion dollars in cash, the new consoles have disc drives, and the company’s S&P credit rating just improved. And, as mentioned, with Playstation 5 and the new XBOX consoles set to be released within weeks, GameStop will rake in tons of money.

So, we know now that bankruptcy is completely off the table. All of the short sellers anticipated this bankruptcy thesis, but they were completely wrong. Thus, they will either have to cover soon or continue paying a borrowing fee. Once the stock rises as a result of all the optimism mentioned above, the margin calls for the short sellers will come. When the short sellers cover, the stock price will increase. A higher stock price means more shorts covering, which only further increases the price. Rinse, repeat.

This, as you may know, is called a short squeeze. We recently saw Kodak (KODK) go from $2 to $60 on a short squeeze, and yet that was only 10-percent shorted at the time. Overstock (OSTK) went from $2 to $120 on a short squeeze. Even KBIO, a failing biotech company that is now defunct, went from 44 cents to $45. None of these companies were 100-percent shorted. GameStop is more than 100-percent shorted! This could be the mother of all short squeezes. My conservative price target for GameStop is $50, but it could easily approach $120 like Overstock if the short squeeze is as nuts as I think it will be.

If you’re looking at the chart, you may have seen that GameStop recently dropped from $15.60 last Friday to $10.49 heading into Halloween weekend. This was the byproduct of election week (most stocks plummeted) and short selling on low volume. Once the volume picks up, presumably after the election and when the consoles are released, GameStop will be back at $15 and will continue to climb.

Nov. 10 update:

GameStop is up about 10 percent since I recommended it here last Monday. There’s exciting news coming beyond the console releases this week:

That’s right – GameStop is now offering free shipping on same-day delivery above orders of $35. That’s awesome because it will allow GameStop to compete with Amazon in their particular sector.

Also, GameStop just filed an 8-K this afternoon. They announced that they are paying off $125 million in debt early. This will crush any sort of bankruptcy thesis the short sellers still may have foolishly believed. GameStop will skyrocket soon, and once it does, it’ll go up even more because of the massive short squeeze.

Dec. 8 update:

GameStop, as of this posting, is in the mid-$16 range. So far, so good.

I wanted to provide an update for Q3 earnings, which will be released after Tuesday’s trading hours are complete. Many traders dump a stock when earnings are announced, even without reading the earnings report. I don’t understand this strategy, but that’s what happens. Check out what happened for $HPE’s Q3 earnings. Hewlett Packard had an amazing Q3 earnings report, but the stock price dropped five percent regardless. It has since risen 20 percent, so those who dumped it can’t feel too smart.

I believe there’s a chance GameStop will immediately drop 5-10 percent, as the Q3 earnings aren’t supposed to be very good. The Q4 earnings will be amazing, but there wasn’t much happening in Q3. However, there’s still a chance GameStop will be higher a week after earnings because we could see great guidance and news during the conference call. GameStop has been getting record sales during the Black Friday/new console release period, so some mention of that would be great.

If you haven’t gotten into $GME yet, I would wait until the earnings dip. I’ll be looking to pick up more shares then.

Dec. 22 update:

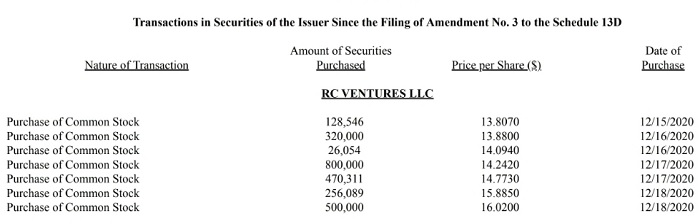

As expected, Q3 earnings tanked GME’s stock price. I thought it would go to the mid-12s and early-13s, and that’s exactly where it went. The price has recently rallied to the mid-15s, as there was a ton of insider buying last week. By whom, you ask? None other than our great friend, Ryan Cohen:

Cohen now owns nearly 13 percent of GameStop. He bought half a million shares at $16.02! He knows where the price of this stock is going, unlike the dumb short sellers who continue to short. Many of them will lose everything in the coming months.

Jan. 19 update:

Congrats to those who have invested into GameStop! I have not sold a single share because the short squeeze hasn’t happened yet. Also, Cohen has seized control of the company. You may have seen that some insiders have sold their shares of GameStop. Those were people on the board of directors whom Cohen has ousted and replaced with his supporters.

Cohen has big-time visions for GameStop. He could take the company to an $8-10 billion market cap, which would make the stock worth well into triple digits. I wouldn’t expect an offering anytime soon either because Cohen specifically discussed crushing the short sellers in his 13D letter to the board.

I’d write more, but there’s a post on Reddit that describes my bull thesis on this company perfectly. The language is vulgar, as a warning, but it’s amazing DD. Here’s the post on why GameStop could approach $300.

Jan. 25 update:

Well, that was something! GameStop hit $73 on Friday before a halt prevented what seemed like a march straight to $100. It closed at $65, but was still up 51 percent on the day.

I was asked by multiple people if the short squeeze is over. I shocked them by telling them it hadn’t even begun! Short interest is still at 140 percent, as Friday’s action was the result of a gamma squeeze. This was the market makers buying shares to hedge against $60 calls that expired on Friday. With the close being $65, all the calls were in the money, meaning all of those shares will have to be bought over the next couple of days. It’s unclear what the exact number of shares is, but it’s estimated between 15 and 20 million. Keep in mind that GameStop’s float is less than 50 million shares!

Here’s a nice write-up on Friday’s GameStop Gamma Squeeze.

I’m still holding full. I’ve set a sell limit at $260, which was just me multiplying Friday’s close by four. I have no idea how high this is going, but once we get into triple digits, I’d suggest setting a very comfortable stop loss in case something crazy happens.

Fantasy Football Rankings - Feb. 19

2026 NFL Mock Draft - Feb. 17

NFL Picks - Feb. 9

NFL Power Rankings - Jan. 26